A sharp hit to risk markets left crypto with heavy losses over the weekend. Reports say roughly $250 billion was wiped from combined market value as investors pulled back. Some of the selling hit Bitcoin hard. Others said it spread to tech stocks at the same time.

Bitcoin Faces A Confidence Test

Bitcoin has been searching for a base. As of today, it slipped below $80,000 and is down about 40% from the 2025 high above $126,000.

Traders and on-chain trackers show weaker buying pressure. Retail interest has cooled. Large outflows from spot ETFs have been recorded, and momentum has been lost across several indicators.

Support near $73,000–$75,000 is now the zone many are watching, while some market participants expect more stops to be run before calm returns.

Markets Are Moving Together

Analysts note that Software-as-a-Service stocks and Bitcoin fell in tandem. That matters because both depend a lot on hopes about future growth; they tend to be hurt first when money gets tight.

Gold was rising at the same time, and some traders argued that the move into bullion drew marginal cash away from riskier bets. When fewer dollars are freely moving between banks, hedge funds trim leverage fast and the riskiest positions suffer most.

— Raoul Pal (@RaoulGMI) February 1, 2026

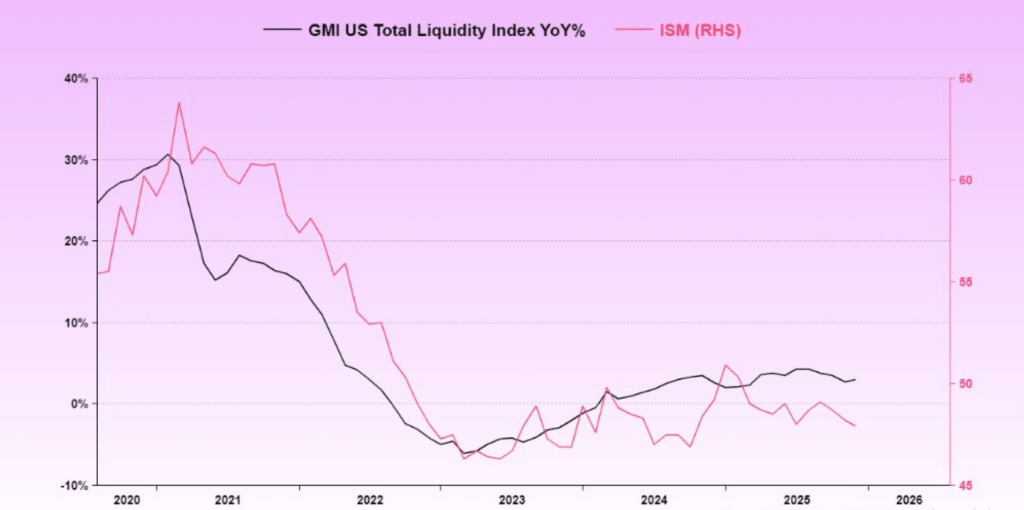

According to Raoul Pal, founder and CEO of Global Macro Investor. the squeeze came from a narrower pool of US dollar liquidity rather than a problem unique to crypto.

The mechanics he points to are technical: Treasury General Account rebuilds, higher funding costs, and a smaller buffer in the Reverse Repo Facility that used to soak up extra cash.

“The rally in gold sucked all marginal liquidity out of the system that would have flowed into BTC and SaaS,” Pal said. “There was not enough liquidity to support all these assets, so the riskiest got hit,” he added.

Those shifts can quietly remove liquidity even when no single headline screams crisis. Government funding hiccups were also blamed for adding friction to the system. When liquidity is chased away, assets tied to future cash flows get hit hard.

Reports say the nomination of Kevin Warsh to run the Federal Reserve has added to the nervous mood. Some market pros worry he won’t cut rates as quickly as hoped.

Some analysts said that sentiment swung on the idea that rate relief might be delayed. But Raoul Pal pushed back, arguing that US President Donald Trump’s team will steer policy toward easier rates and that Warsh will follow that playbook.

Views differ. That uncertainty has left many traders unwilling to put fresh money into stretched trades.

A Cautious But Not Despairing CloseAt the time of writing, price action looks fragile and rallies have been short-lived. Yet some analysts expect the liquidity drain to ease and for capital to trickle back once funding conditions normalize.

The coming weeks will show whether buyers return around the low-$70k area or if selling finds a deeper level. Reports note that risk appetite often returns before headlines change, but only when dollars are flowing again.

Featured image from Unsplash, chart from TradingView

from Bitcoinist.com https://ift.tt/VnRpSKE

Comments

Post a Comment