Bitcoin’s current price outlook may appear bearish and volatile, but sentiment is leaning toward a bullish narrative in the short and long term. Despite the ongoing waning price action, large BTC players are showcasing interest and conviction in the flagship crypto asset as they continue to stack long positions.

Large Players Go Long on Bitcoin

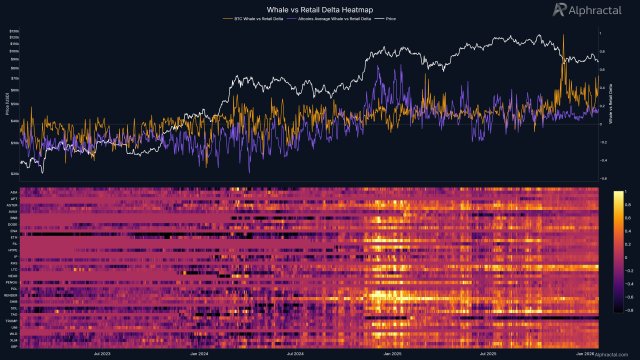

In the midst of heightened volatility and sideways performance, Bitcoin investors are showing up at a significant rate. Joao Wedson, a market expert and the founder of Alphractal, has shared an analysis that shows that Bitcoin’s large participants, also regarded as whales, are quietly shifting into a bullish phase.

As highlighted in the research on the X platform, the cohort continues to accumulate long positions while the broader market begins to set up. Currently, the Whale vs Retail Delta Heatmap is demonstrating a clear divergence as institutional players are positioning ahead, while retail remains cautious, but longs remain the dominant side overall.

With Bitcoin’s price waning, this suggests that whales are not reacting to short-term noise. Rather, they could be positioning themselves early for a possible shift in direction toward the upside. Such a behavior from the cohort hints at rising confidence in the asset’s medium-term to long-term prospects.

The divergence between Bitcoin and altcoins indicates that large investors are betting their capital on BTC rather than distributing risk throughout the market. Thus, a period of Bitcoin-led market leadership may be unfolding underneath the surface due to the increasing prevalence of whale-driven BTC longs.

In the past, Wedson stated that this setup is capable of increasing the probability of forced liquidations driven by crypto exchanges. However, if the metric continues to display strength, the expert claims that it has mostly occurred close to important market bottoms, especially when whale condition grows across multiple timeframes.

Multiple Long Positions Have Been Liquidated

Long positions in Bitcoin may be growing, but the journey has not been a smooth one. In another X post, Wedson reported that BTC has liquidated a large portion of long positions that were opened over a period of 30 days.

Wedson added that this massive liquidation shows that the majority of traders are still betting on an upside trajectory in the crypto market. However, cryptocurrency exchanges and OG investors are steadily moving against consensus, as they attract easy liquidity from unprepared players.

The Bitcoin liquidation map is telling a story. CryptoPulse’s analysis of the Bitcoin Exchange Liquidation Map shows that sell-side liquidation is currently stacked, which might push the price upward after the recent downside move. This accumulation implies that if the price rises, a significant concentration of short bets may be compelled to unwind, which could increase volatility. Should the structure allow it, a natural relief push is on the horizon.

from Bitcoinist.com https://ift.tt/fVmbKo8

Comments

Post a Comment