Bitcoin (BTC) is holding firmly above the $110,000 level after a volatile week defined by macro catalysts and lingering market stress following the October 10 liquidation shock. The US Federal Reserve delivered a 25-basis-point rate cut and confirmed that quantitative tightening will officially end on December 1, signaling a meaningful shift toward a more supportive liquidity environment moving into year-end.

While markets initially reacted with volatility, Bitcoin has shown resilience, stabilizing above a key price zone that traders are closely watching for signs of renewed momentum.

Sentiment remains cautious yet constructive as the market continues to digest the aftermath of the October crash — the largest forced-selling event in crypto history. Although leverage has been significantly reduced, flows are gradually returning to spot markets, and the price structure shows early signs of rebuilding.

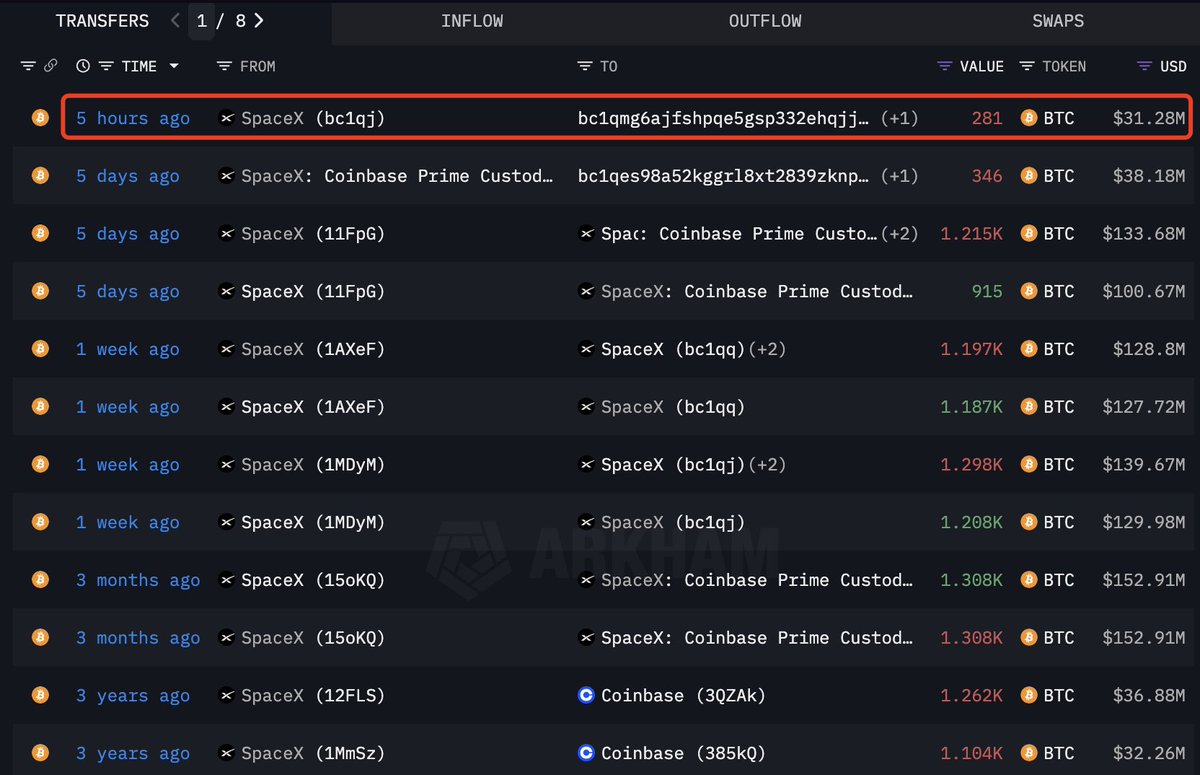

Adding to on-chain activity, new data from Lookonchain shows that SpaceX recently transferred 281 BTC (worth roughly $31.28M) to a fresh wallet, marking yet another movement of corporate-held Bitcoin — likely for custody or treasury management purposes.

With macro conditions shifting and on-chain players repositioning, investors are watching closely to see whether Bitcoin can maintain its foothold and reclaim higher levels in the coming sessions.

SpaceX Bitcoin Transfers Spark Institutional Speculation as Analysts Turn Bullish

According to on-chain data shared by Lookonchain, SpaceX has moved its Bitcoin holdings three times in the past 10 days, including a recent transfer of 281 BTC. While the movements appear custody-related rather than exchange deposits, the frequency and size of these transactions have fueled speculation across the market.

Some traders interpret the activity as internal wallet restructuring, while others see it as part of a broader trend of institutional repositioning ahead of what many believe could be a liquidity-driven market expansion phase.

These moves come at a time when macro conditions appear increasingly supportive for Bitcoin. With the Federal Reserve cutting rates and ending quantitative tightening, capital conditions are shifting toward accommodation for the first time since the tightening cycle began. This pivot has strengthened the bullish narrative that Bitcoin may be entering a new global liquidity regime where institutional demand accelerates.

Several analysts argue that BTC is now in one of the most favorable macro environments since early 2020, with long-term holders distributing supply gradually and spot markets showing robust participation.

The October 10 crash forced excess leverage out of the system, resetting positioning while preserving structural demand. That combination — cleaner market structure, improving liquidity, and steady institutional activity — forms the foundation of the current bullish thesis. Analysts point out that corporate entities and large funds tend to make strategic adjustments before major trend shifts become obvious.

While near-term volatility remains possible, the repeated movement of corporate-controlled BTC like SpaceX’s adds to a growing sense that deep-pocketed players are preparing for the next phase of the cycle. If Bitcoin can maintain its footing above key technical levels and liquidity continues flowing back into spot markets, many believe a significant upward expansion could unfold faster than market participants expect.

Bitcoin Holds Above 200-Day MA as Price Consolidates Below Key Resistance

Bitcoin (BTC) is currently trading near $110,200, defending a critical support area after another rejection from the $117,500 resistance zone. The daily chart shows BTC struggling to sustain momentum above the 50-day (blue) and 100-day (green) moving averages, suggesting that short-term sellers are still active around the mid-$110,000 region.

Despite this, price continues to hold above the 200-day moving average (red), a key long-term trend indicator that reinforces the market’s broader bullish structure.

The October 10 liquidation event created a sharp wick into the $104,000–$106,000 range, and since then, Bitcoin has been forming a higher-low structure, signaling a gradual stabilization phase. For bulls, the key objective remains reclaiming the $113,500–$115,000 area, where the 50- and 100-day MAs converge.

Clearing this zone would strengthen bullish conviction and set the stage for a retest of $117,500, a decisive breakout level that could open the door toward $120,000–$123,000.

On the downside, a daily close below the 200-day MA and $108,000 support would weaken the current bias and raise the risk of a deeper pullback toward $104,000. For now, Bitcoin remains in a neutral-to-constructive consolidation, holding key support while awaiting fresh catalysts for its next directional move.

Featured image from ChatGPT, chart from TradingView.com

from Bitcoinist.com https://ift.tt/QSf6v9s

Comments

Post a Comment