Arkham Intelligence’s new deep-dive, shared via X on September 6, pegs Vitalik Buterin’s wealth at “at least $1.05 billion”—a lower-bound tally built from identified on-chain assets and known private holdings. The report situates the estimate as of August 2025 and emphasizes that it fluctuates intraday with Ether’s price.

How Rich Is Ethereum Co-Founder Vitalik Buterin?

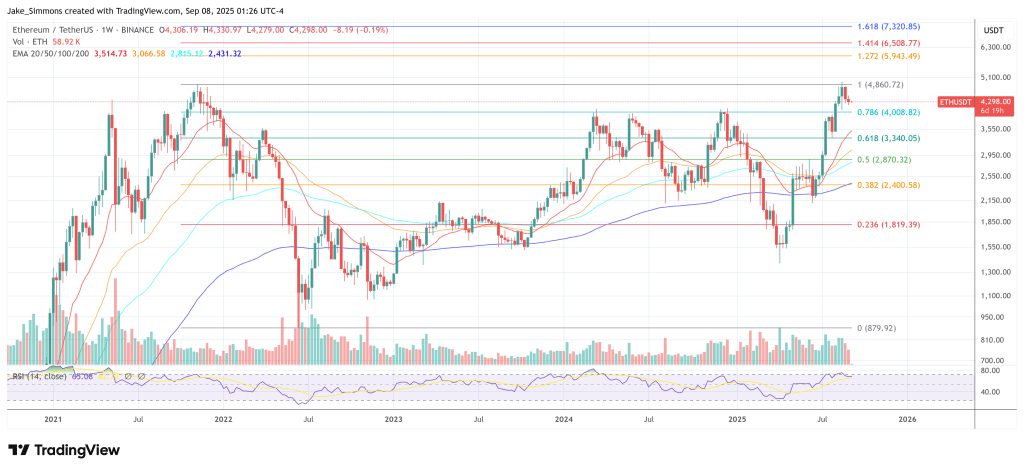

The backbone is Ether itself. Arkham attributes ~240,042 ETH to Buterin’s known wallets and notes that over 99% of his crypto portfolio value is in ETH. At the time of writing in the report, ETH was $4,321, implying roughly $1.04 billion of ETH exposure alone and explaining the tight co-movement between his net worth and ETH’s market cycle.

Historically, Arkham reconstructs a precise balance-history curve. On December 31, 2015, Buterin’s known crypto wealth stood at $596,760; by December 31, 2016 it was $4.23 million, then $278.37 million a year later—his largest year-over-year jump in the 2017 bull run.

He first crossed the on-chain billionaire mark at age 27 during 2021 as ETH traded above $3,000, and briefly peaked at $2.09 billion on November 18, 2021 with ETH near its cycle high. The subsequent bear market slashed the mark-to-market value by roughly 75%, from $1.2 billion (Dec 31, 2021) to $300.58 million (Dec 31, 2022), before recovering to $1.05 billion in the 2024–2025 rebound.

“The peak of Vitalik’s crypto net worth was in May 2021, when 50% of the supply of the memecoin SHIB was sent to him and was briefly worth $20 Billion. Vitalik donated those tokens to charity and did not profit off of this memecoin,” Arkham writes.

On ownership concentration, Arkham compares Buterin to other top-tier ETH holders. The ETH2 (Beacon) deposit contract leads with 66,887,347.41 ETH, followed by exchange and ETF-custody clusters (Coinbase, Binance, Kraken, Robinhood, Grayscale, BlackRock). Arkham concludes Buterin is the largest identifiable individual with access to his coins, while Estonian banker Rain Lõhmus sits on ~250,000 ETH that are believed to be inaccessible due to lost keys.

The Ethereum co-founder’s own disclosures anchor the percentages. In October 2018 he wrote: “I never had 900k ETH. When I had 0.9% of all ETH, the supply was ~75 million.” That statement frames Arkham’s finding that his share never materially exceeded ~0.9% and has trended down over time as he sold or donated and as supply evolved.

Non-ETH positions are small in dollar terms but spelled out with exact counts. As of publication, Arkham shows 10,000,000,000 WHITE (~$3.72 million), 30,000,000,000 MOODENG (~$690,000), and 869,509 KNC (~$327,000) among his larger non-ETH tokens. The long tail includes $12,400 of TORN linked to Tornado Cash usage and 218,413,000 SHIB (~$2,720) remaining on known addresses.

Buterin has publicly explained some of the flows that complicate “sales” tallies. In August 2022 he stated, “I’ll out myself as someone who has used [Tornado Cash] to donate to this exact cause,” referring to donations to Ukraine; he has also said that exchange-bound transfers from his wallets since 2018 have been for donations, not personal profit-taking.

Off-chain, Arkham highlights early equity in zero-knowledge firm StarkWare, which reached an $8 billion valuation in its 2022 Series D—an illiquid but potentially meaningful additive to the on-chain floor. Precise sizing of these stakes is not disclosed, so Arkham treats the $1.05 billion as a conservative baseline rather than a cap.

At press time, Ethereum traded at $4,298.

from Bitcoinist.com https://ift.tt/YSBb34A

Comments

Post a Comment