Bitcoin’s price experienced a slight upward push after a temporary rebound on Wednesday, but the leading crypto asset is still in a bearish state, now pulling back to $111,000. However, it appears BTC is likely to regain its upside momentum soon, as key on-chain metrics point to a decline in the ongoing volatile phase of the market.

Implied Volatility In Bitcoin Falls To New Lows

Amid the highly mixed market sentiment, XWIN Research, a Japanese expert, outlines a potential shift in the Bitcoin market trend from bearish to bullish. According to the expert, the ongoing pullback in BTC’s price is likely the calm before the storm, and on-chain data has confirmed that the market is easing.

Bitcoin’s Implied Volatility Ratio hints at this changing market trend, which has fallen to levels not seen in years, indicating that its price movements are beginning to show signs of constraint. This decrease in market volatility suggests a maturing phase for the crypto king, during which traders will be more firmly rooted in long-term conviction and less susceptible to short-term shocks.

XWIN Research highlighted that Bitcoin’s implied volatility is currently at its lowest level since 2023, a moment in the past that came before a remarkable +325% surge from the $29,000 level to $124,000.

Given that the development previously preceded a massive surge in price, the primary question now is whether the same “quiet before the storm” dynamic is playing out once more. However, while implied volatility indicates one of the quietest periods in years, history indicates that these times are rarely sustained.

Bullish Signals From Other BTC Metrics

In the meantime, the expert has underlined about 3 crucial on-chain metrics that are probably supporting the quiet before the storm narrative. These key metrics include BTC Exchange Reserve, the Market Value to Realized Value (MVRV) Ratio, and BTC Funding Rates.

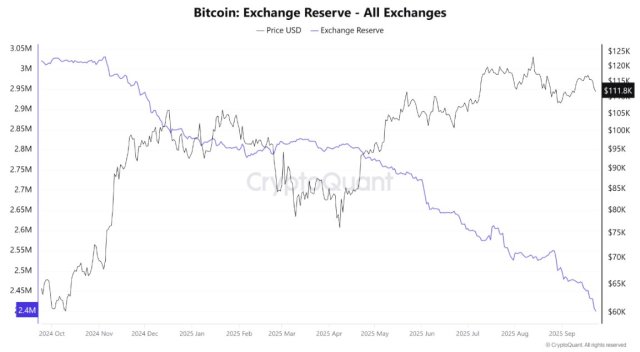

Currently, these metrics are painting a consistent picture and exhibiting a bullish trend that shows underlying momentum in Bitcoin’s market. After investigating, XWIN Research revealed that the BTC balance on crypto exchanges has declined.

When demand suddenly increases, dwindling reserves have historically been considered a sign of impending supply constraints. The metric continues to decrease, pushing it closer to its multi-year lows, indicating that fewer coins are available for instant sell-off.

Furthermore, its MVRV Ratio is now in a neutral zone around the 2.1 level. This measure, which tracks investors’ action, suggests they are neither heavily underwater nor sitting on excessive gains. Thus, pressure to panic-sell or rush into profit-taking is diminishing, strengthening the “wait-and-see” notion in the market.

Lastly, XWIN Research noted that BTC Funding Rates are still positive but moderate across major crypto exchanges, demonstrating that derivatives traders are not excessively leveraged on longs or shorts. In the absence of extremes, the subdued volatility is mirrored, suggesting that the market is holding onto potential energy instead of burning it up too soon. Considering the bullish signals from these metrics, Bitcoin may be poised for its next big move; the only question left is which way the energy will flow.

from Bitcoinist.com https://ift.tt/yVu9s7v

Comments

Post a Comment