Bitcoin surged to a fresh all-time high of $124,500 yesterday, marking another milestone in its historic 2025 run. However, the celebration was short-lived as the world’s largest cryptocurrency faced immediate selling pressure, pulling prices back and signaling the start of a new phase in market dynamics. The rally, fueled by weeks of strong buying momentum, now confronts a critical inflection point.

Analysts are split on what comes next. Some believe the recent peak could mark the start of a momentum fade, with traders locking in profits after the record-setting move. Others, however, see the pullback as a healthy pause before an explosive push higher, potentially targeting levels well above $125,000 if buying strength returns.

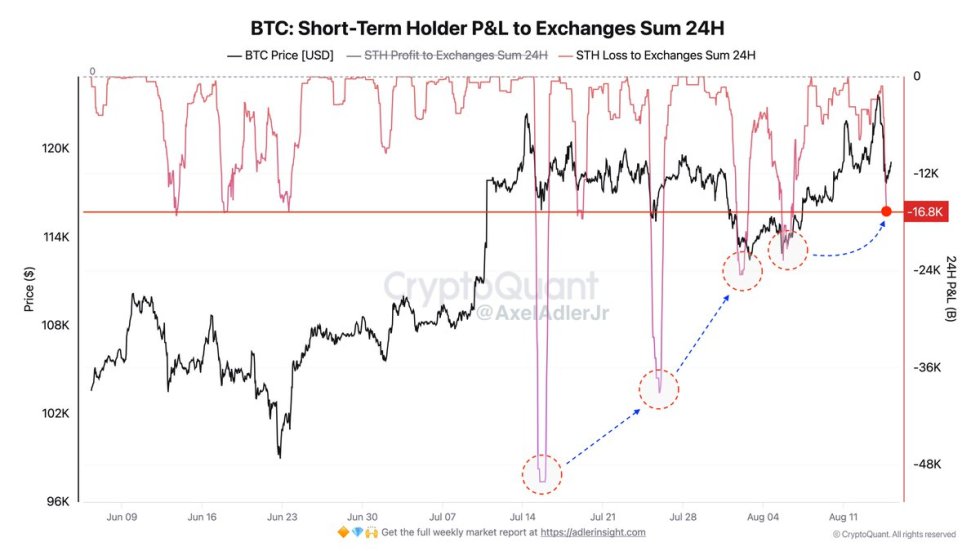

On-chain data from CryptoQuant adds an interesting layer to the outlook. Short-term holders are currently selling at a loss, but the intensity of this selling has been weakening compared to previous corrections. This reduced pressure suggests that the market may be absorbing the supply more effectively, a factor that could limit downside risk in the short term.

Short-Term Holder Selling Pressure Weakens

According to top market analyst Axel Adler, Bitcoin’s latest pullback revealed a notable shift in market dynamics among short-term holders (STH). During yesterday’s retracement from the $124,500 all-time high, around 16,800 BTC were sent to exchanges at a loss by STH—a figure significantly lower than in previous drawdowns. Historical comparisons show that capitulation events earlier this year involved much larger selling volumes, suggesting a gradual decrease in panic-driven exits.

Adler points to a visible trend on-chain: the amplitude of STH capitulation selling, represented by blue arrows on his chart, has been shrinking over time. This decline in selling pressure reflects improved resilience among recent buyers and stronger overall market absorption. Simply put, the market is no longer reacting with the same intensity to pullbacks, a sign that short-term participants may be holding with greater conviction.

While bullish momentum has cooled following the record high, price action remains structurally strong. Bitcoin is still trading well above its major moving averages, indicating that broader market support is intact. Investors appear to be positioning for the next decisive move, whether it’s an attempt to reclaim and break above $125,000 or a period of consolidation to reset momentum.

Bitcoin Tests Support After Rejection at Record Highs

Bitcoin’s 4-hour chart shows a volatile week, with price spiking to $124,500 before facing strong rejection near the $123,217 resistance level marked in yellow. The pullback drove BTC to retest the $118,000 area, where the 200-period SMA (red) provided notable support, halting further downside.

Short-term momentum indicators suggest a fragile recovery. The 50-period SMA (blue) is still above the 100-period SMA (green), indicating that the broader trend remains bullish despite recent selling pressure. However, price is now consolidating just below the $119,000 mark, reflecting market hesitation ahead of a potential retest of the highs.

For bulls, reclaiming $120,000 will be key to regaining momentum and setting up another push toward the $123,000–$124,500 zone. On the downside, a clean break below $118,000 could open the door to a deeper retracement toward $116,900 and potentially $115,000.

BTC remains in an uptrend on the 4-hour timeframe, but the rejection at all-time highs and subsequent consolidation signal a cooling phase. Traders will be watching for either a breakout above resistance to confirm continuation or a loss of support that could shift sentiment more bearish in the short term.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/2ZVfjD3

Comments

Post a Comment