After setting a new all-time high of $124,500, Bitcoin is now battling to hold the $115,000 level as support. The bulls, who dominated just days ago, are struggling to spark a fresh rally, leaving the market in a delicate phase. While fundamentals such as institutional adoption and strong holder demand continue to support the broader uptrend, capital flows suggest a new dynamic is at play.

Several analysts note signs of capital rotation from Bitcoin into altcoins, a pattern that often marks transitions between phases of the market cycle. Ethereum, in particular, is emerging as a major destination for this shift.

Adding to the intrigue, on-chain intelligence firm Lookonchain has been tracking the movements of a long-dormant Bitcoin OG whale, who has reawakened with extraordinary activity. On Friday, the whale deposited 300 BTC ($34.86 million) into Hyperliquid to sell for Ethereum. His bold strategy is paying off: he’s now sitting on over $100 million in unrealized profits.

The whale currently holds a 135,265 ETH ($581M) long position at a $4,295 average entry, up $58 million, and also accumulated 122,226 ETH ($535M) spot at a $4,377 average, up $42 million. This aggressive rotation underscores a pivotal moment—one where Bitcoin consolidates, but altcoins, led by Ethereum, may capture the spotlight.

Bitcoin OG’s Bold Rotation Into Ethereum

According to Lookonchain, the mysterious Bitcoin OG whale continues to dominate market headlines with aggressive on-chain moves. Most recently, he transferred another 4,000 BTC (~$460 million) into exchanges, where the funds were converted into Ethereum. This marks yet another large-scale repositioning that has captured the attention of analysts and investors alike.

So far, the whale has accumulated a staggering 179,448 ETH (~$806 million) at an average price of $4,490, alongside a 135,265 ETH ($581 million) long position that remains open. These bold allocations underscore a decisive rotation strategy away from Bitcoin and into Ethereum, suggesting a bet on ETH’s outperformance in the coming phase of the cycle.

The implications are significant. On one hand, such a massive capital shift highlights growing institutional-style conviction in Ethereum as it pushes through all-time highs and challenges Bitcoin’s dominance. On the other hand, it raises concerns about short-term volatility.

Analysts warn that despite the bullish outlook, a shakeout may occur before sustained gains materialize. With leverage in derivatives markets climbing and liquidity thinning in spot trading, sharp pullbacks could easily flush out overextended positions.

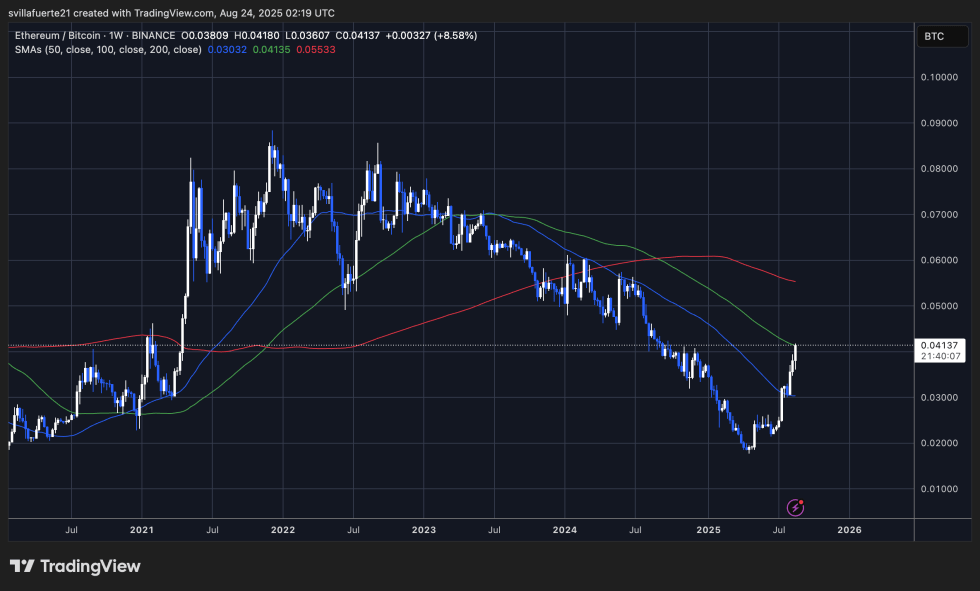

Bitcoin Vs. Ethereum: Weekly Chart AnalysisThe ETH/BTC weekly chart shows Ethereum gaining significant ground against Bitcoin after a long downtrend that lasted from mid-2022 to early 2025. ETH has now rallied to the 0.041 BTC level, posting strong bullish candles and reclaiming key moving averages. The 50-week SMA (blue) has just been broken to the upside, and price is testing the 100-week SMA (green), an important resistance zone. If ETH manages to sustain momentum above this level, the next key target lies near the 200-week SMA (red) around 0.055 BTC.

This rotation is especially important because ETH has been underperforming Bitcoin for over two years. The recent surge signals a potential capital rotation from BTC into ETH, a trend reinforced by large institutional buys and whales shifting positions into Ethereum.

On the downside, if ETH/BTC faces rejection at the current resistance, the pair could retest support around 0.035 BTC, which aligns with previous consolidation. However, momentum indicators suggest strength is currently with Ethereum.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/NBDFY5h

Comments

Post a Comment