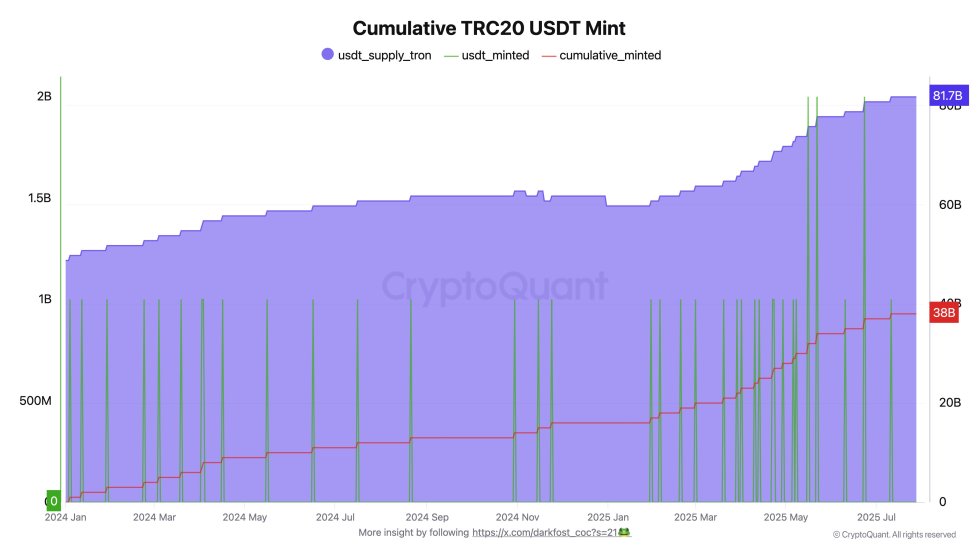

Tron continues to dominate the stablecoin landscape, with another $1 billion in USDT minted just yesterday—bringing the total minted on the network in 2025 to a staggering $23 billion. This marks the strongest year for USDT supply expansion on Tron since the peak of the 2021 cycle. With this latest mint, the total USDT supply on Tron now stands at $81.7 billion, further solidifying its position as the leading blockchain for Tether issuance.

Historically, large-scale USDT mints have been viewed as bullish signals for the broader crypto market. These events often precede periods of increased liquidity, signaling that traders and institutions are preparing fresh capital for strategic deployment. As USDT acts as a primary on-ramp into crypto markets, its expansion is closely watched as a proxy for incoming demand.

The timing of this mint is especially important, coming as Bitcoin consolidates near all-time highs and altcoins show growing volatility. With capital ready on the sidelines, many analysts believe the market could be on the verge of another expansion phase. If history is any guide, Tron’s latest $1B mint may mark the beginning of a new wave of inflows across the digital asset ecosystem.

Tron’s $1B USDT Mint Signals Bold Shift Toward Financial Integration

Top analyst Darkfost suggests that Tron’s latest $1 billion USDT mint is unlike previous ones—and could mark a turning point for the ecosystem. Unlike standard mints, this $1B issuance has not yet appeared on-chain. According to the transaction hash, the funds were transferred to a multisig wallet, where they remain inactive, pending further authorization.

No transaction fees were paid, a strong indicator that this is an inventory replenishment mint authorized by Tether but not yet put into circulation. For now, it doesn’t reflect in on-chain supply metrics, but the intent behind it carries deeper implications.

What makes this mint especially significant is its timing. It comes just days after Tron.inc was listed on Nasdaq and shortly after Justin Sun confirmed the submission of an S-3 filing with the US Securities and Exchange Commission (SEC). That filing includes the proposed issuance of hybrid securities totaling exactly $1 billion—the same amount as the mint. These securities could take the form of common stock, preferred shares, or debt instruments.

The overlap in timing and value suggests a coordinated strategy: Tron may be preparing to intertwine traditional financial instruments with stablecoins in a capital-efficient, compliant structure. If true, this would be a precedent-setting move for the crypto space, positioning Tron not just as a blockchain for transfers but as a fully integrated financial platform.

This mint, though not yet live on-chain, may be the first step in a broader vision that bridges TradFi and DeFi—leveraging stablecoin liquidity as a tool for regulated fundraising and capital management. For Tron, this could be the most significant development since its inception.

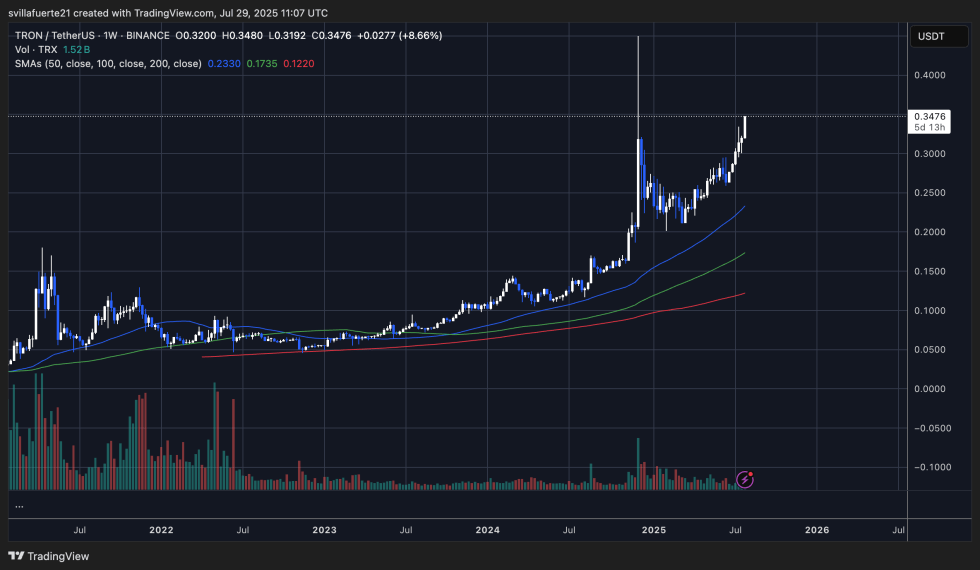

TRON Breaks Higher As Weekly Chart Signals Bullish Continuation

TRX is showing strong bullish momentum on the weekly chart, currently trading at $0.3476 after gaining 8.66% in the last session. This move pushes TRX to its highest weekly close since early 2022, breaking past local resistance levels and approaching its cycle high. The price action reflects a well-structured uptrend that began in early 2023, supported by rising volume and a clear series of higher highs and higher lows.

The 50-week SMA ($0.2330), 100-week SMA ($0.1735), and 200-week SMA ($0.1220) are all trending upward and now lie far below the current price—confirming the strength and maturity of the trend. TRX remains firmly above all major support zones, with no immediate signs of exhaustion on the chart.

If TRX sustains above the $0.32–$0.34 range, the next major resistance could come near $0.40. A clean weekly close above current levels would likely open the door to further upside in Q3, especially if broader market conditions remain favorable.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/6EjHz0m

Comments

Post a Comment