In a stunning development, 80,000 Bitcoin (BTC), valued at over $8.6 billion, have been moved into new wallets setting a wave of speculations across the crypto market. Contributing to this discourse, Conor Grogan, Head of Product at Coinbase has stated there is significant possibility that this series of recent whale transactions could be an actual crypto heist.

Did The Largest Bitcoin Theft Just Unfold In Silence?

In an X post on July 4, prominent analytics firm Arkham Intelligence firm reports that a single entity has now transferred 80,000 BTC in equal portions into eight new wallets. On-chain data reveals that these Bitcoin holdings were originally deposited into their previous wallets on April 2 and May 4, 2011, suggesting over 14 years of complete dormancy.

As with other major whale transactions, the recent activation of these long-held BTC have alerted market traders and investors alike especially amidst the present BTC price struggles. Although, the fact that these transfers did not involve exchange-affiliated wallets has helped ease concerns of an imminent market sell-off.

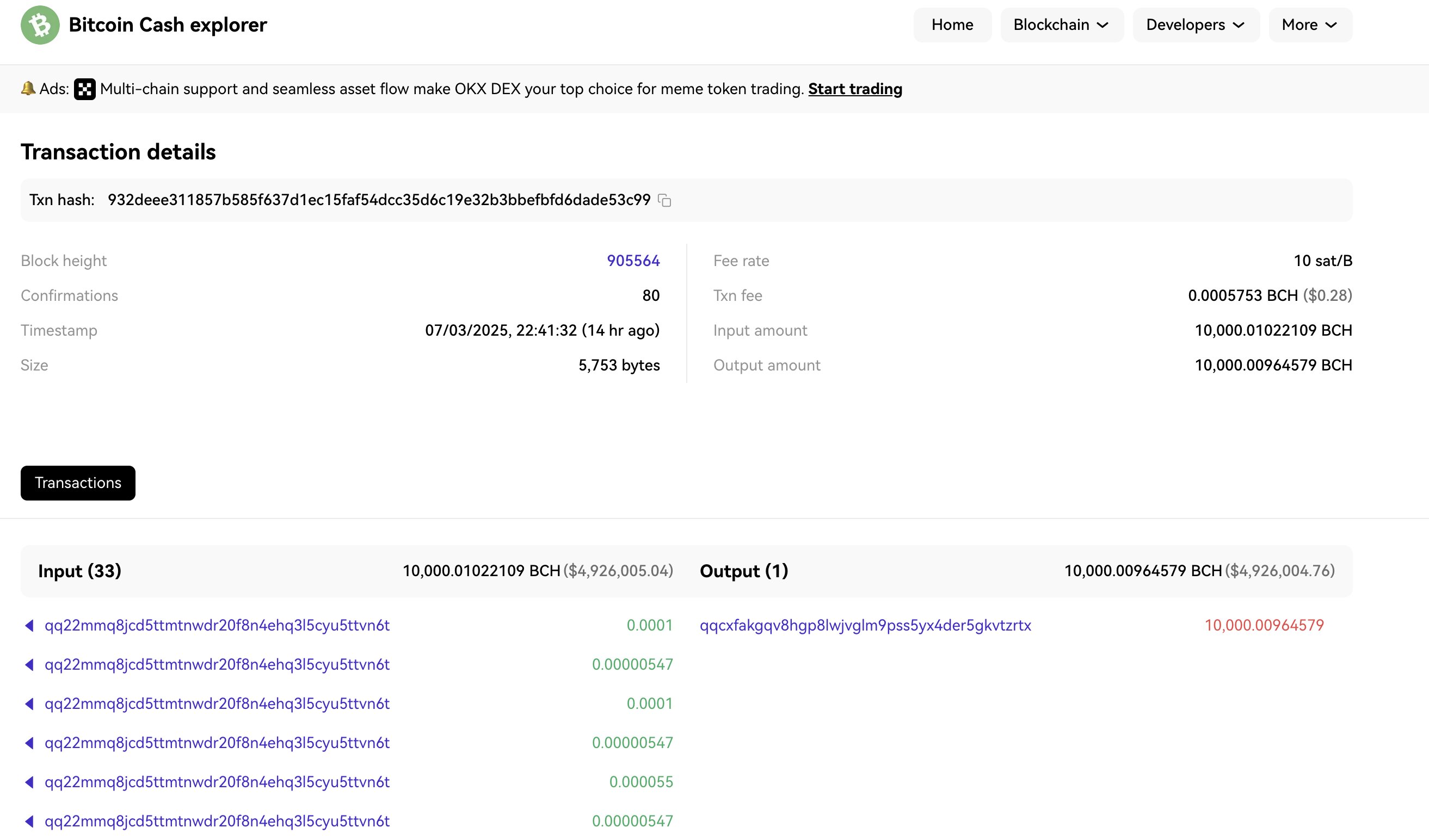

However, Conor Grogan has warned these sudden Bitcoin transfers might have been the largest crypto heist in history. In explaining this theory, the Coinbase executive draws attention to a small Bitcoin Cash (BCH) transaction from one of the corresponding wallet clusters approximately 14 hours prior to the massive Bitcoin movements.

The transaction which is a test-like output of 10,000 BCH valued at roughly $4.9 million was traced on the Bitcoin Cash blockchain. Grogan explains the fact that other BCH wallets remained dormant suggest that this particular BCH transfer might have been hackers testing the private key as BCH transactions are now usually tracked by whale monitoring services. Another concern highlighted by the Coinbase executive is the transfers were not automated or exchange-related, but rather appeared to be manual transactions, thereby increasing suspicions of compromised private keys. Nevertheless, Grogan retains the position that this theory represents “extreme speculation” suggesting the transactions may have indeed been initiated by the wallet’s rightful owner. Notably, several crypto analysts and enthusiasts have pushed back against Grogan’s narrative, describing the recent 8,000 BTC transfer as a “handshake transaction” rather than a hack. In particular an analyst with X username binji pointed out that the slow and deliberate pace of the transactions seemed inconsistent with the behavior typically observed in hacks, especially if they were executed by a single entity.

Bitcoin Price Overview

At the time of writing, Bitcoin exchanges hands at $108,150 following a 1.06% decline in the past day. However, the leading cryptocurrency maintains a positive performance on larger time frames as evidenced by gains of 0.98% and 2.78% on the weekly and monthly chart respectively.

from Bitcoinist.com https://ift.tt/k9FjleV

Comments

Post a Comment