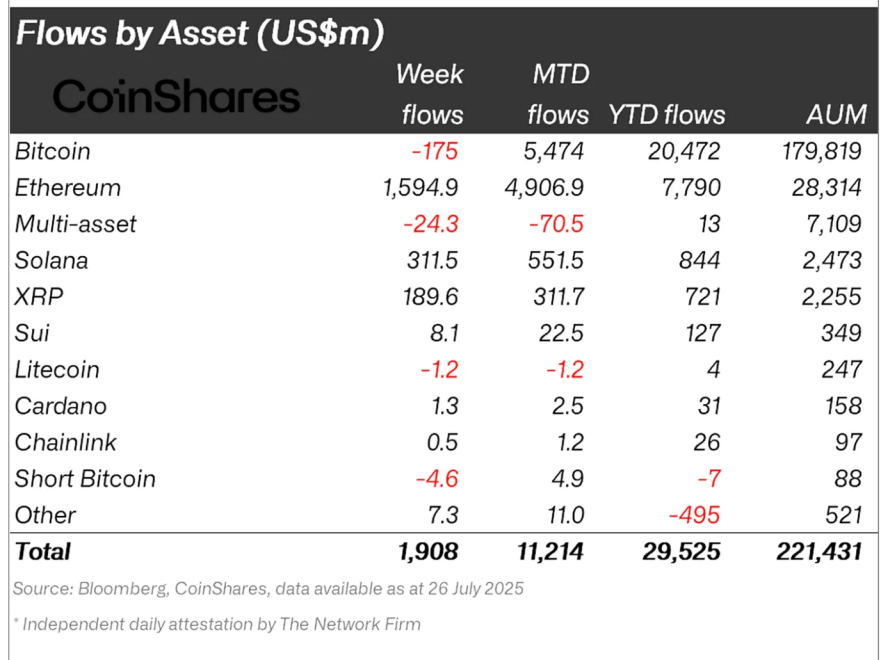

The digital asset investment space maintained its upward trajectory last week, with inflows into crypto investment products reaching $1.9 billion, according to the latest data published by CoinShares.

This marks the 15th straight week of positive net inflows, indicating sustained institutional interest even as market conditions remain volatile. The report highlights a significant surge in capital deployment compared to previous months, with July’s month-to-date total already at $11.2 billion, setting a new monthly record.

James Butterfill, head of research at CoinShares, emphasized the magnitude of these flows, noting they have already surpassed the $7.6 billion seen in December 2024, which had been buoyed by post-election optimism in the United States.

However, despite the strong overall figures, regional flow dynamics revealed mixed investor behavior. While the US and Germany collectively attracted over $2 billion, other regions such as Brazil, Canada, and Hong Kong experienced capital outflows totaling nearly $270 million.

Ethereum Outpaces Bitcoin Amid Shifting Institutional Preferences

In a noteworthy shift, Ethereum emerged as the leading asset by inflows last week, recording $1.59 billion. This marked the second-largest weekly haul for Ethereum investment products on record. With year-to-date inflows now at $7.79 billion, Ethereum has already outpaced its total intake for the entirety of 2024.

This trend points to growing institutional interest in Ethereum’s evolving role within the digital asset ecosystem, particularly as developments surrounding ETH spot ETFs and staking alternatives continue to gain traction.

Bitcoin, on the other hand, saw minor net outflows totaling $175 million. While modest in absolute terms, the divergence in flow trends compared to Ethereum and other altcoins has prompted discussion about a possible transition toward an “altcoin season.”

Butterfill, however, cautioned against drawing broad conclusions too soon. Still, the report highlighted notable activity in several altcoins: Solana and XRP recorded $311 million and $189 million in inflows respectively, while SUI attracted $8 million.

Meanwhile, other assets like Litecoin and Bitcoin Cash registered small outflows, suggesting selective interest rather than a broad-based rotation.

ETF Anticipation May Be Fueling Altcoin Demand

One of the key drivers behind the renewed interest in select altcoins may be expectations around potential spot ETF approvals in the United States.

Crypto regulatory anticipation has historically had an outsized impact on asset flows, and current momentum around Solana and XRP may reflect a forward-looking positioning by investors hoping to capitalize on future ETF launches.

Notably, this aligns with patterns observed in late 2023 and early 2024 when Bitcoin ETF speculation triggered similar inflow spikes.

Looking ahead, sustained inflows into altcoins will likely depend on broader regulatory developments and macroeconomic cues, including decisions from the US Securities and Exchange Commission and global central banks.

For now, Ethereum’s inflow dominance and Bitcoin’s relative stagnation present a curious contrast that will be closely monitored in the weeks to come.

Featured image created with DALL-E, Chart from TradingView

from Bitcoinist.com https://ift.tt/hHZLyC5

Comments

Post a Comment