Bullish pressure is returning to the crypto market as Bitcoin, the largest digital asset, rebounded strongly after dropping below the $100,000 mark during the weekend. The recent pullback appears to have influenced the sentiment of short-term investors as indicated by a negative MVRV reading.

Bitcoin’s Short-Term Investors Turn Cautious

While Bitcoin and the market are slowly turning green, several key metrics are still in a bearish state. A recent report from Glassnode, a world-leading financial and on-chain platform, highlights a negative trend among short-term BTC holders.

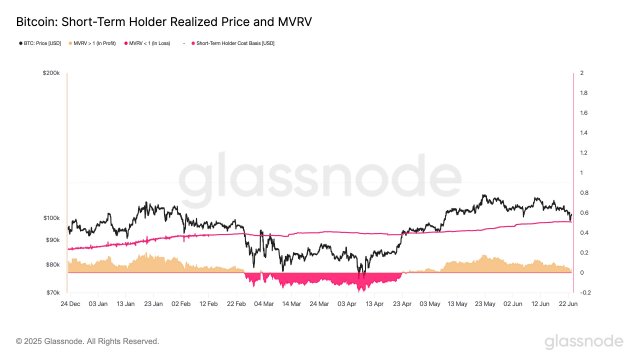

The Bitcoin short-term holder Market Value to Realized Value (MVRV) ratio has declined sharply. Specifically, this metric is frequently used to assess sentiment and profitability among more recent market participants.

Therefore, this notable drop in the key STH MVRV metric reflects the growing unease of recent investors due to the ongoing volatility of BTC’s price. It also points to weakening conviction sentiment among short-term holders.

Starting with the BTC Short-Term Holders Realized Price, Glassnode noted that the asset has persistently found support in the range since April. According to the platform, this range is also the cost basis of investors holding BTC for more than 155 days.

Even though this range has held strongly, the short-term holders’ MVRV is currently decreasing and is situated at just 0.03, a level that shows growing pressure on newer investors with only 3% unrealized gains.

It is worth noting that BTC Short-Term Holders Realized Price is currently positioned at the $98,100 price mark. During the weekend, Bitcoin retested this level due to the heightened volatility observed across the crypto market.

Even though recent corrections have rebounded close to this level, Glassnode noted that the Cost Basis Distribution indicates a denser supply slightly below, at about $97,000 to $98,000. In the meantime, this zone might serve as a true pivot in the following drawdown as pressure builds up on newer BTC holders.

Behavior Of BTC Investors

In another X post, Glassnode has outlined the current action of BTC investors following an analysis of the Bitcoin Supply By Investor Behavior metric. The metric is often used to determine the activity of investors, whether they are selling or holding.

Glassnode’s main area of focus in this crucial metric is the Loss Sellers, which is observed to have risen significantly in the past few days. Typically, this uptick in loss sellers signals increasing uncertainty and frustration among players who purchased BTC at higher price levels. Data from the platform reveals that this cohort has grown from 74,000 to 95,600, representing an increase of over 29% since June 10.

While pressure on weak hands has spiked, Conviction Buyers also witnessed a notable increase. A rise in Conviction Buyers suggests that sentiment is not collapsing. Presently, some are reducing losses while others are actively reducing their cost basis.

from Bitcoinist.com https://ift.tt/R4wato3

Comments

Post a Comment