After trading at nearly $112,000 to establish a new all-time high (ATH), Bitcoin has since slipped into a corrective phase losing over 7% of its value since then. Despite this market downturn, prominent crypto analyst with X username KillaXBT has tipped the premier cryptocurrency to regain its bullish form, and soon re-enter price discovery territory.

Bitcoin Traders Should Swing Long At $104,000 – Analyst

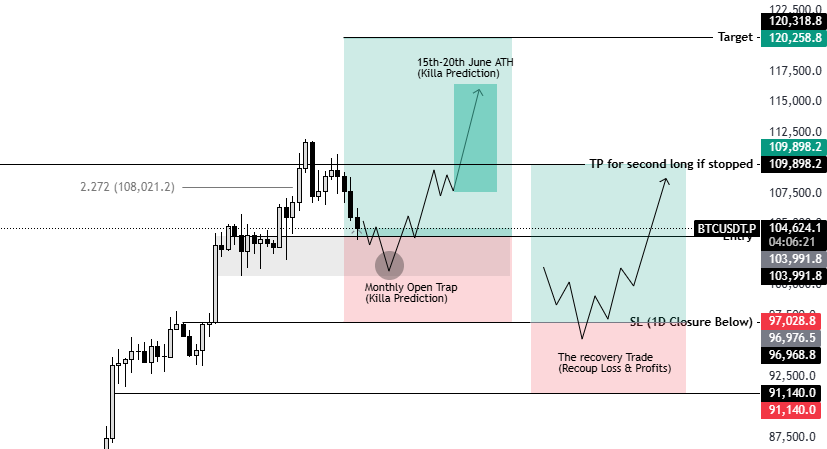

In an X post on May 30, KillaXBT has shared a bullish Bitcoin price prediction nudging investors to open a long position at the $104,000 price zone. The analyst who has previously made similar calls when Bitcoin traded at $76,000 and $94,000 is backing the asset’s potential to reach a price target of $120,000 by mid-June. Concerning the ongoing market correction, KillaXBT explains that the recent decline was well expected and aligns with the existing bullish price map. Therefore, there is little need for investors to turn bearish.

Furthermore, the analyst moves to reiterate that Bitcoin’s current uptrend can be described as sideliners’ rally. This is because despite a significant increase in M2 Money Supply signaling a rise in market liquidity, there is also low participation from investors and traders as indicated by the negative premium index and low funding rates.

This multiple developments suggests the present bullish momentum is built on long-term conviction by possibly institutional investors or market whales strengthening the potential for a sustainable price rally. From the trading chart presented, KillaXBT’s analysis suggested that Bitcoin’s price correction has created a monthly open trap just below the $104,000 at investors are advised to open a long position with a price target of $120,000.

However, the market expert also acknowledges the potential for a market upset noting that a decisive price close below $97,000 would nullify the purported bullish set-up. In such a scenario, KillaXBT proposes a recovery trade by opening another long position right below $97,000, targeting a rebound toward $109,000 to recoup losses and maintain upside exposure.

Bitcoin Price Prediction

At the time of writing, Bitcoin trades at $104,519 after a price increase of 0.70% in the past day. Meanwhile, the asset’s trading volume is down by 34.21% suggesting a fall in market activity and transaction numbers.

According to popular prediction site CoinCodex, Bitcoin investors are highly bullish despite recent price drops. Coincodex shares a similar sentiment with a price prediction of $132,409 in the five days suggesting a potential 26% gain on the current market prices.

from Bitcoinist.com https://ift.tt/SPhNT1c

Comments

Post a Comment