The price action of Bitcoin has been quite strong over the past week, exhibiting good signs of recovery from last weekend’s low. While the premier cryptocurrency travelled as high as $108,000 in the last few days, it is now hovering around the $107,000 mark. The latest on-chain data suggests that a group of investors has stayed out of the market despite the price resilience of Bitcoin in recent months.

BTC Retail Demand Falls By 10% In June: Analyst

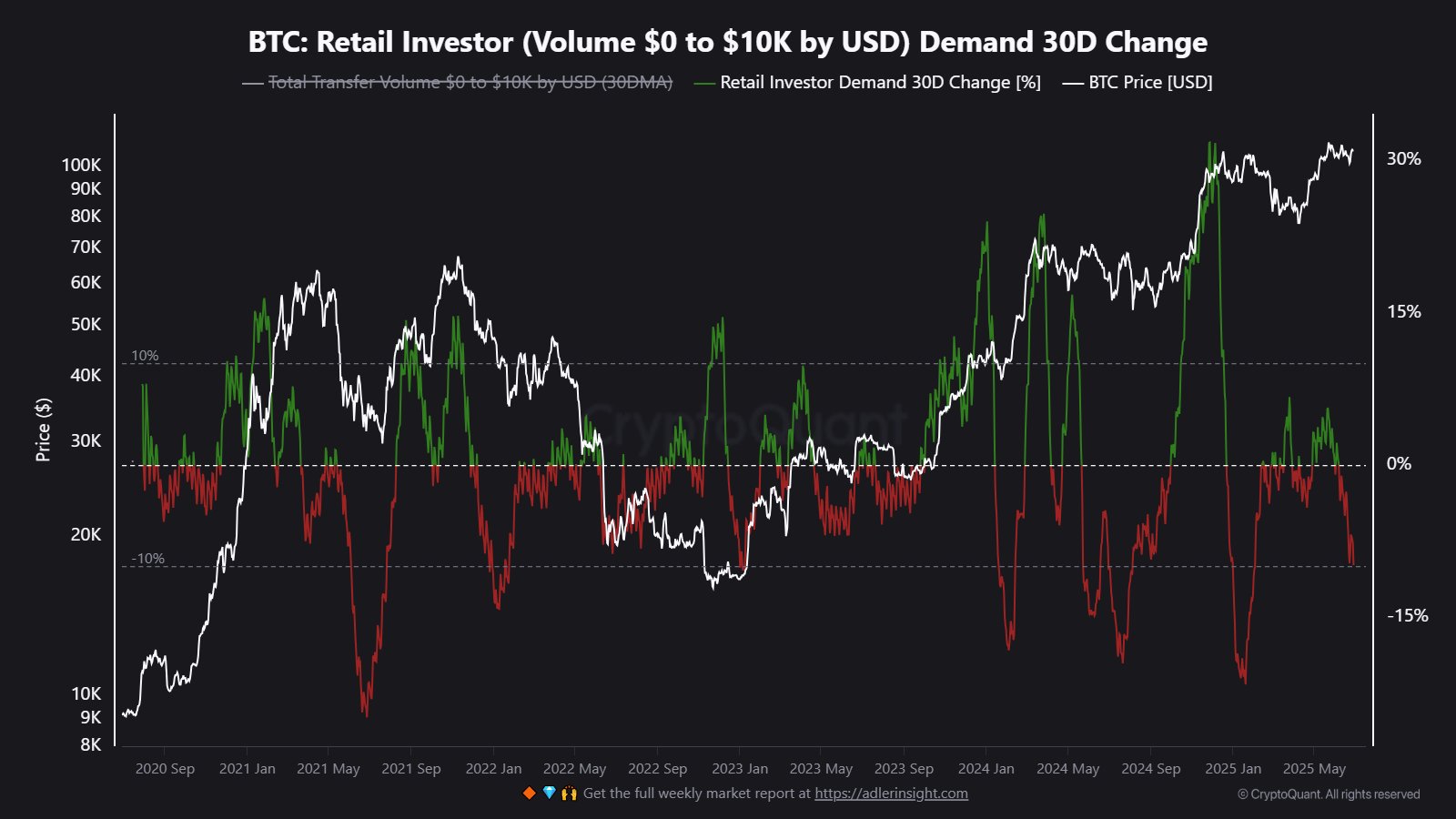

In a June 28 post on social media platform Z, on-chain analyst Maartunn revealed that a cohort of market participants known as retail investors has been relatively inactive over the past few months. This on-chain revelation is based on the Retail Investor Demand metric, which estimates the demand for BTC amongst small-scale investors.

In essence, this on-chain metric tracks the activity of small wallets typically involved in transfers of small sizes. Specifically, this Retail Investor Demand indicator measures the percentage change in the cumulative volume of small transactions (worth $10,000 or less) over a 30-day period.

In the chart highlighted by Maartunn, the 30-day change in the Bitcoin Retail Investor Demand plunged into the negative territory and has remained in the red since early June. More recently, the metric fell to the 10% level, which represents the lowest level in more than six months.

Considering that the Bitcoin price action has been fairly steady in this period, it is quite surprising that small-scale investors have refrained from entering the market. The market seems to be rather dominated by institutional investors — primarily through the spot Bitcoin exchange-traded funds.

Institutional And Bitcoin ETF Investors Take Charge

This trend of falling retail demand was also spotlighted by on-chain analyst Burak Kesmeci on the X platform, saying that institutional investors and spot ETF investors seem to currently have a strong appetite for accumulating Bitcoin. In the past week, the US-based BTC exchange-traded funds posted a significant weekly total net inflow of $2.2 billion.

Furthermore, Kesmeci mentioned that if the decline in retail demand continues, it could mean that the Bitcoin price is nearing a bottom. Hence, the flagship cryptocurrency could enjoy some bullish momentum and upward price movement over the coming weeks.

As of this writing, the price of BTC stands at around $107,244, reflecting a mere 0.1% increase in the past 24 hours. According to data from CoinGecko, the market leader is up by more than 4% on the weekly timeframe.

from Bitcoinist.com https://ift.tt/zhSjasf

Comments

Post a Comment