Bitcoin surged nearly 5% in under 24 hours yesterday, pushing decisively above the $110,000 level and reigniting momentum across the crypto market. The move signals growing strength from bulls, who are now targeting a breakout beyond the all-time high at $112,000 to confirm trend continuation and open the door for price discovery.

Analysts are calling this a pivotal moment for Bitcoin. After weeks of consolidation and volatility, BTC has reclaimed key territory — but to sustain the rally, a clean break above the all-time high is crucial. Until then, the risk of rejection or sharp pullbacks remains on the table, especially with growing macroeconomic uncertainty and thin liquidity in spot markets.

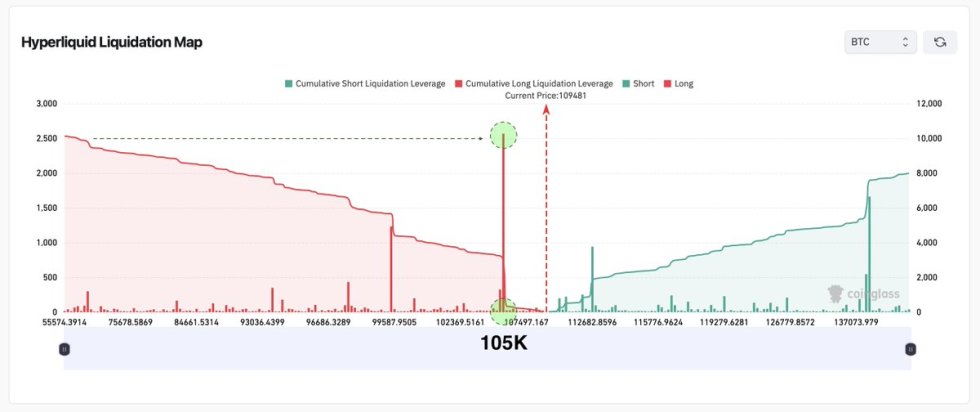

Adding to the caution, data from HyperLiquid’s liquidation map reveals a significant cluster of long position liquidations concentrated around the $105,000 mark. Bitcoin’s trend remains bullish, but the market is approaching a decision point. A breakout above the ATH would confirm strength and likely lead to aggressive upside. Failure to follow through, however, could set the stage for heightened volatility in the days ahead.

Bitcoin Consolidates As Long Liquidation Risks Grow

After an impressive 50% rally that brought Bitcoin to its all-time high of $112,000, the market has shifted into consolidation mode. Price is now hovering just below ATH levels, with bulls holding control but struggling to push decisively into price discovery. Momentum has cooled, and BTC appears to be waiting for a fresh catalyst to resume the uptrend.

The recent volatility began in late May, when macroeconomic uncertainty and market-wide retracements shook sentiment. However, Bitcoin has held up remarkably well, maintaining key support levels and defending the $105,000–$107,000 range. This strength has helped sustain the broader bullish structure, with higher lows forming on the chart and no major breakdowns despite macro headwinds.

Top analyst Axel Adler recently shared insights from HyperLiquid’s liquidation map that add complexity to the current setup. According to Adler, there is a significant concentration of long position liquidations clustered around the $105,000 level. This creates a potential “magnet effect” — where bearish momentum could be drawn toward that zone to trigger stop-outs and forced liquidations, amplifying downside pressure if support breaks.

For now, Bitcoin remains rangebound between $105K and $112K. Traders are watching for either a clean breakout into new highs or a sweep of lower support to test market resilience. Until a decisive move occurs, patience is critical. With the current structure still leaning bullish, the next catalyst — whether macroeconomic, regulatory, or sentiment-driven — will likely determine whether BTC enters full price discovery or revisits support.

BTC Retests $109K After Breakout As Bulls Defend Gains

Bitcoin is currently trading at $109,547 on the 4-hour chart, consolidating just above the key $109,300 resistance level after a sharp breakout. The move above this level, which had previously capped upside since late May, marked a significant shift in momentum as BTC surged nearly 6% over the past two sessions. The price is now attempting to stabilize after briefly hitting a high of $110K.

The breakout was supported by rising volume and a clean move above all major moving averages — including the 50 SMA ($105,553), 100 SMA ($106,294), and 200 SMA ($105,615) — which now act as strong dynamic support levels. The bullish momentum remains intact as long as the price holds above $109,300. A successful retest of this level would confirm it as new support and could set up a push toward all-time highs at $112,000.

However, if BTC fails to hold this level, the price may revisit the $106,000–$107,000 range, where buyers previously stepped in. The structure remains bullish overall, but with resistance overhead and potential long liquidation clusters below, volatility is likely to remain elevated.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/KSkTNm4

Comments

Post a Comment