On-chain data shows the Bitcoin short-term holder whales have been taking significantly more profits than the diamond hands in this rally.

New Bitcoin Whales Are Participating In Notable Profit-Taking

In a new post on X, CryptoQuant author Axel Adler Jr. discussed how profit-taking has recently looked from the two major Bitcoin whale cohorts: the short-term holder and long-term holder whales. The short-term holders (STHs) and long-term holders (LTHs) are two broad divisions of the BTC network done on the basis of holding time, with the cutoff between them being 155 days.

Similarly, ‘whales‘ are also a classification of the asset’s investors, but in this case, the criterion is holding balance. More particularly, whales are defined as holders with more than 1,000 BTC. As such, the STH and LTH whales would refer to the big-money members of the STH and LTH groups, respectively.

Now, here is the chart shared by the analyst that shows the trend in the total amount of profit realized by these groups during the past few months:

As displayed in the above graph, both of the groups have participated in some degree of profit-taking recently. Still, clearly, the new whales who got into the market in the past five months have been the ones making up for the majority of this selling. This trend is different from how it was in January, when the profit realization was more balanced across these cohorts.

Historically, the STHs have tended to be reactive to market events, while the LTHs have shown resilience. So, the whales falling to the temptation of profit realization in the recent rally may not be too surprising. That said, so far, the profit-selling in the market hasn’t yet reached the same highs as in January.

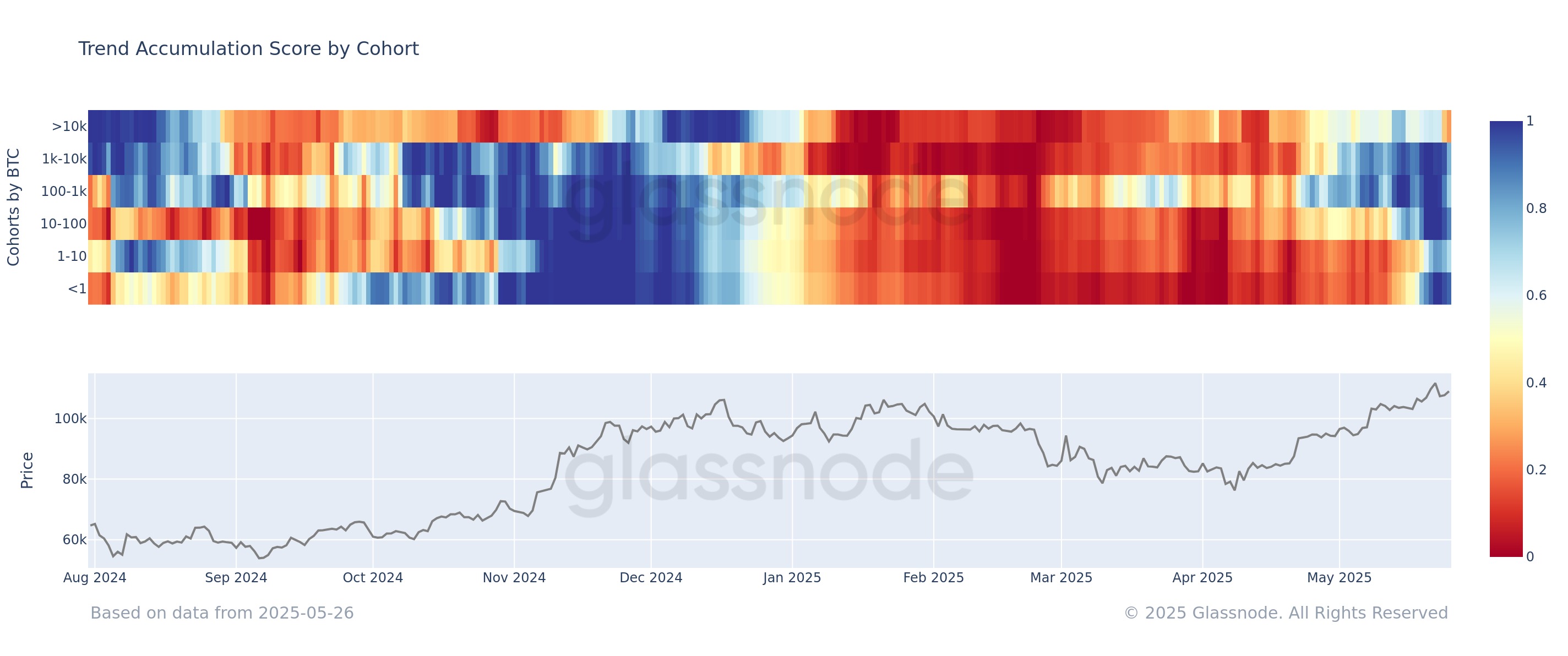

The whales represent a broad group that can be divided further into the regular-sized whales (1,000 to 10,000 BTC) and ‘mega’ whales (10,000+ BTC). According to data from the on-chain analytics firm Glassnode, the two groups haven’t been showing consistent behavior recently.

As is visible in the above chart, the Bitcoin Accumulation Trend Score, an indicator that tells us about whether the investors are accumulating or distributing their coins, has been close to 1 for the whales recently, a sign that these large entities have been displaying strong accumulation.

The smaller cohorts have also been displaying a similar behavior, but the mega whales have diverged from the rest as they have taken to distribution instead.

BTC Price

At the time of writing, Bitcoin is floating around $109,800, up around 6% in the last seven days.

from Bitcoinist.com https://ift.tt/MkrTcIq

Comments

Post a Comment