During the ongoing market uptrend, Bitcoin continues to lead the bullish wave as the leading crypto asset records significant gains, pushing it to price levels above $95,000. While BTC’s price may have seen notable positive movements above $95,000, this key level now stands between an impending decline.

A Pullback Incoming For Bitcoin?

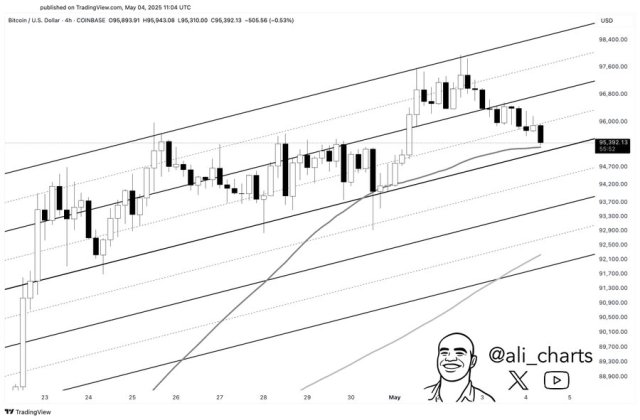

As Bitcoin charges toward the upside direction, Ali Martinez, a technical and on-chain expert, has revealed the importance of the $95,000 price level. The flagship asset is currently up against a critical test at a pivotal price point that might decide whether there is enough fuel left for the current climb to last.

Martinez’s recent analysis suggests that this level could act as the foundation for more upward movements or a potential pullback in price. It is important to note that Bitcoin’s price is currently testing the $95,000 mark, demonstrating the possibility of an uptrend due to bullish sentiment in the market.

However, if BTC fails to hold above this level, the next possible pullback might cause its price to drop to $92,000. In the meantime, attention is being drawn to the $95,000 zone, which has historically acted as both a launchpad and a barrier for BTC.

Network Interest Dwindles Despite Holding Above The Level Uptrend

While this $95,000 milestone is believed to ignite widespread on-chain engagement, transaction volume, and active addresses remain at low levels, even amid market enthusiasm. Alphractal, an advanced on-chain data and investment platform, cited a waning interest in the Bitcoin blockchain. However, it is worth noting that the high cost of Bitcoin does not always translate into more participants using the blockchain.

The reduction in on-chain activity indicates that the renewed investors’ enthusiasm might not yet be reflected in actual network usage. Currently, on-chain dynamism is occurring elsewhere, whereas Bitcoin is being viewed more like a financial asset, suggesting a notable shift in dynamics.

Alphractal has attributed the waning blockchain activity to historically low volatility. This is because traders are less motivated to act when there is little price movement, which results in fewer on-chain transactions.

Considering the development, Alphractal noted that the current uptrend seems to be driven by external factors. Institutional interest and capital inflows through Spot Bitcoin Exchange-Trade Funds (ETFs) have recently impacted Bitcoin’s current value more than actual blockchain deployment.

Another reason for this disconnection is artificial crypto exchange volumes, as some platforms may be inflated, giving the impression of increased activity when actual network usage remains low. Limited practical demand is not left out. During this period, prices are maintained primarily by financial instruments and derivatives speculation rather than by widespread blockchain adoption.

Bitcoin blockchain’s fading interest is also due to the market entering into a consolidation phase. Alphractal stated that investors are waiting for lucid signs or macro developments, leading to a reduction in coin movements.

Even as BTC’s price moves upward, adoption and on-chain transactions have been shifted to layer 2 solutions like the Lightning Network rather than the Bitcoin Blockchain. Alphractal highlighted a speculative use of other major networks. Typically, high-traffic areas such as Decentralized Finance (DeFi), staking, and meme coin activity are being drawn to networks like Ethereum, Solana, and Base.

from Bitcoinist.com https://ift.tt/HUb5EKj

Comments

Post a Comment