After a weekend of consolidation just below its all-time high near $112,000, Bitcoin is entering the new week with momentum building and bullish sentiment rising. Trading around $110K, BTC continues to hold a strong technical structure, and many analysts believe it’s only a matter of time before the next leg higher begins. With volatility tightening and the broader market gaining strength, all eyes are on Bitcoin as it flirts with price discovery once again.

Conviction is growing among top analysts who are now calling for significant price surges in the weeks ahead. On-chain metrics and price action continue to support the bullish outlook, pointing to sustained demand and a resilient trend structure. However, one emerging factor worth watching is miner behavior.

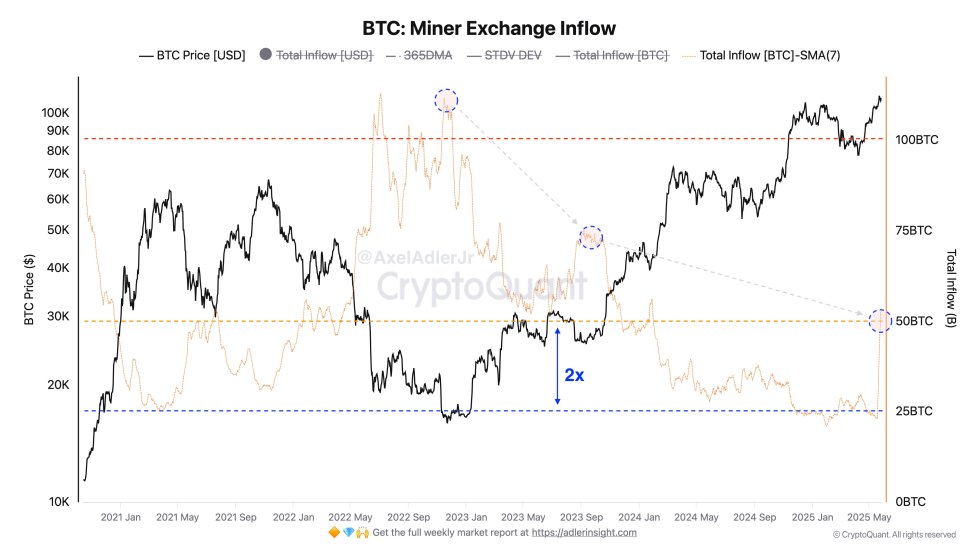

Top analyst Axel Adler shared new insights revealing that after hitting the ATH, miners have increased their BTC sales on exchanges. Inflows have doubled from an average of 25 BTC to 50 BTC per day, suggesting a profit-taking trend.

Bitcoin Prepares A Move As Market Absorbs Increased Miner Selling

Bitcoin is positioning itself for a potentially explosive phase as sentiment across the market grows increasingly bullish. Trading just below its all-time high near $112,000, BTC remains in a strong uptrend, and the coming days are likely to prove pivotal in confirming whether the next leg higher is ready to begin. With price action holding firm and bullish structure intact, many analysts believe an impulsive breakout could be imminent.

Adding fuel to the outlook is the broader global context. Trade tensions between the US and other major economies continue to escalate, and markets are becoming more reactive to macro uncertainty. In this environment, Bitcoin is once again being viewed as both a hedge and a high-beta growth asset—one that thrives in periods of volatility.

Adler shared key insights on miner behavior that may influence short-term price action. Since Bitcoin’s recent ATH, miner inflows to exchanges have doubled, from an average of 25 BTC to 50 BTC per day. While this indicates a noticeable uptick in selling, Adler notes that these levels remain well below historical peaks of around 100 BTC per day.

More importantly, the market appears to be absorbing this added supply without showing signs of stress. This suggests that demand remains robust, and selling pressure from miners is not yet strong enough to derail the uptrend. Instead, it reflects a healthy and expected shift in behavior following a major price milestone.

As Bitcoin hovers near all-time highs, the combination of strong market structure, supportive on-chain data, and resilient demand could set the stage for a powerful continuation. If bulls reclaim $112K with conviction, BTC may enter a fresh price discovery phase with targets well beyond current levels.

Bulls Hold Range Above $108K

Bitcoin is trading at $109,676 on the 4-hour chart, consolidating in a tight range just below its all-time high near $112,000. After a brief retracement from local highs, BTC has maintained its bullish structure, forming higher lows and staying well above key moving averages. The 34 EMA (green) at $108,639 acts as dynamic support, while the 50 and 100 SMAs (purple and blue) at $108,271 and $105,958 provide additional downside protection.

Volume has slightly declined during this consolidation, indicating a temporary pause rather than a reversal. Price remains comfortably above the major horizontal support level at $103,600—now a critical base for any deeper pullbacks. The uptrend remains intact as long as this zone holds.

What’s notable is BTC’s ability to hold above the 34 EMA despite increased miner inflows and broader market caution. This resilience suggests strong buyer interest and positioning ahead of a potential breakout.

To confirm continuation, bulls need to reclaim the $111K–$112K range with volume. A break above this resistance would likely trigger the next impulsive leg higher. For now, Bitcoin remains in a bullish consolidation phase, with strong support levels anchoring price action as the market awaits a decisive move.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/DnkoLgj

Comments

Post a Comment