The Ethereum token has been under significant bearish pressure over the past few months, losing almost half of its value in the first quarter of 2025. Along with the rest of the altcoin market, ETH bled severely following the announcement of new trade tariffs by United States President Donald Trump.

Interestingly, the suspension of these trade tariffs didn’t have as much of a bullish effect on the “king of the altcoins,” which failed to hold above the $1,600 level in the past day. This inability of the Ethereum price to mount a convincing recovery emphasizes the token’s struggles in recent months.

Is The Price Bottom In For ETH?

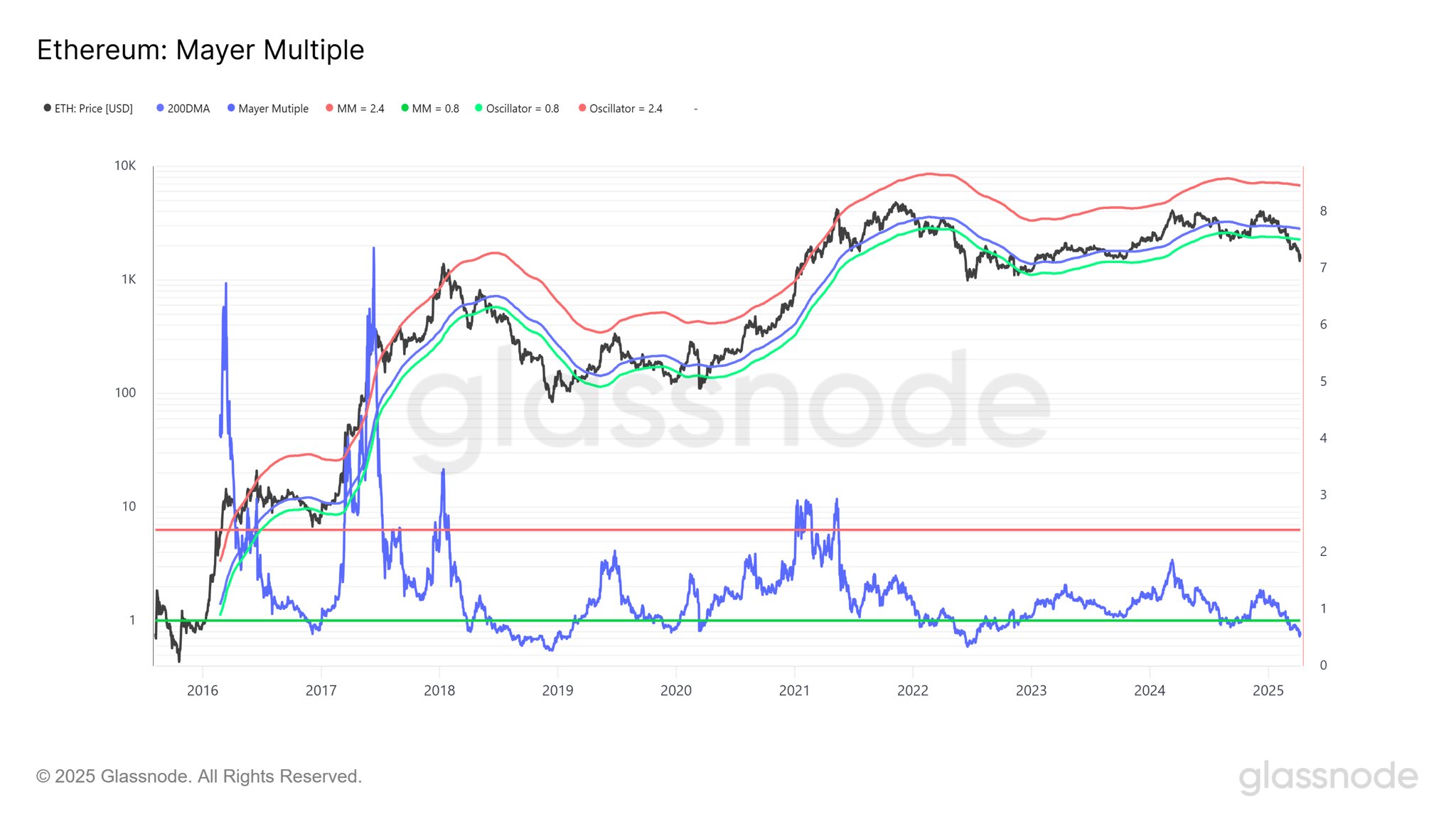

Crypto analyst with the pseudonym Cryptollica shared fresh on-chain insight in a post on the X platform, suggesting that the price of Ethereum could be at a pivotal point of bullish reversal. This projection is based on the Mayer Multiple indicator, which measures the ratio between an asset price and its 200-day moving average (MA).

The 200-day MA represents the long-term average price of an asset; and the Mayer Multiple estimates the distance of the asset’s actual price from this average value to determine overbought and oversold conditions. The metric indicates an overheating market condition and a potential price top when its value is above the 2.4 mark.

On the flip side, a Mayer Multiple value below 0.8 signals an oversold condition and that the asset’s price might have hit a bottom. Ultimately, the metric is used to determine macro bull or bear his when analyzing cyclical price changes.

According to the Glassnode chart shared by Cryptollica, the Ethereum Mayer Multiple recently slipped beneath the 0.8 mark. This suggests that the price of ETH might be bottoming out, with a potential bullish reversal on the horizon.

Moreover, the last time the Mayer Multiple indicator fell to this low in 2022, the price of Ethereum rebounded to above the $4,000 mark — the price high in the current cycle. If history repeats itself, the second-largest cryptocurrency could embark on another journey to $4,000 — an over 150% rally from the current price point — over the coming months.

Ethereum Price At A Glance

As of this writing, the price of ETH stands at around $1,550, reflecting a mere 1% jump in the past 24 hours. Despite the slightly improving market sentiment, the altcoin’s performance on the weekly timeframe has remained almost the same. According to CoinGecko data, the Ethereum price is down by nearly 15% in the past seven days.

from Bitcoinist.com https://ift.tt/idcrTHS

Comments

Post a Comment