Bitcoin is holding firm above the $85,000 mark, signaling early signs of a recovery as market sentiment begins to shift. The renewed momentum follows last week’s major geopolitical development: a 90-day tariff pause announced by U.S. President Donald Trump for all countries except China, which continues to face a 145% trade tariff. The announcement injected optimism into global markets, with Bitcoin responding positively after weeks of volatility and uncertainty.

Now, BTC is eyeing a breakout above critical supply levels near $87K–$90K, levels that could mark the beginning of a broader uptrend if breached with volume. According to new insights from CryptoQuant, since Friday, bulls have taken control of the derivatives market—an encouraging sign that leverage is now favoring upward momentum.

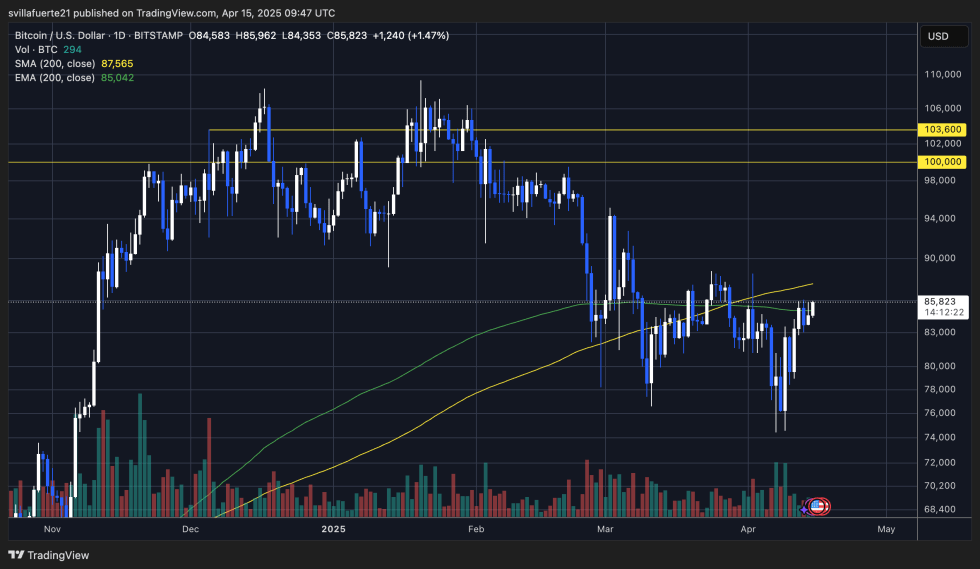

While macroeconomic risks remain, including ongoing trade tensions and interest rate uncertainty, market structure is beginning to show signs of strength. Key technical levels are being tested, and if bulls maintain their current position in both spot and derivatives markets, a push toward $90,000 could come sooner than expected. All eyes now turn to how BTC behaves around its 200-day moving averages, as another leg higher may hinge on that breakout.

Bitcoin Builds Strength as Bulls Take Control of Key Indicators

Bitcoin appears to be preparing for a potential market surge, as bulls continue to push the price above critical technical levels. After weeks of uncertainty and high volatility, Bitcoin’s recent resilience above the $85,000 level is signaling growing momentum among buyers. Despite the positive signs, macroeconomic tensions remain a key factor influencing sentiment. US trade policy, geopolitical unrest, and recession fears continue to create a fragile environment for risk-on assets like crypto.

Some analysts remain cautiously optimistic, calling for a recovery rally if Bitcoin maintains its position above the 200-day exponential moving average and key short-term support zones. Others, however, remain skeptical, warning that continued uncertainty could trigger another leg down if confidence fades.

Top analyst Axel Adler shared new insights on X, highlighting that the Bitcoin cumulative net taker volume—a measure of aggressive buying versus selling—has flipped positive. This suggests that buyers are stepping in with increasing conviction.

Additionally, Adler noted that since Friday, bulls have taken control of the derivatives market, which further strengthens the bullish case. When combined with growing spot demand and on-chain accumulation signals, this shift in momentum may support a broader move higher in the coming sessions.

BTC Price Faces Crucial Resistance as Bulls Lose Momentum

Bitcoin is trading at $85,700 after struggling to reclaim the 200-day exponential moving average (EMA), a key level that often signals the beginning of trend reversals. While bulls managed to hold BTC above the $85K mark, the price is still trading below the 200-day simple moving average (SMA), currently sitting around $87,500. This level has become a strong resistance zone, and until it’s decisively breached, Bitcoin remains vulnerable to another sharp move downward.

The broader market environment remains uncertain, and momentum appears to be weakening. Despite last week’s bounce triggered by the 90-day tariff pause announcement, follow-through buying has not been strong enough to reclaim higher supply zones. A decisive move above $90,000 is essential to confirm a bullish trend continuation and invalidate the current consolidation range.

If bulls fail to generate enough strength to reclaim that level, a deeper retracement could follow. The key support remains at $81K, but if that fails, BTC could revisit the $75K region—a level that previously acted as a short-term bottom during last month’s correction. For now, traders are closely watching for a breakout or breakdown, as Bitcoin teeters at a critical inflection point.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/Q37fchN

Comments

Post a Comment