Bitcoin is now trading above the $94,000 level, showing strong momentum after a sharp recovery from recent lows. Bulls are pushing hard to reclaim the $95,000 mark, a critical level that could signal the continuation of an uptrend toward new all-time highs. However, despite the growing optimism, risks remain elevated as global trade conflicts and macroeconomic uncertainty continue to weigh heavily on financial markets.

Conflict between the US and China persists, creating a fragile environment that could quickly impact investor sentiment. Still, Bitcoin has shown resilience, decoupling from traditional markets in recent sessions and maintaining strong price action even as equities falter.

According to CryptoQuant data, a key bullish signal is emerging: the Coinbase Premium Gap has stayed positive for 265 straight hours. Historically, a positive premium reflects strong buying pressure from US-based investors, often preceding significant price rallies. This ongoing trend suggests that institutional demand remains healthy, supporting the current move higher.

While the short-term outlook is encouraging, Bitcoin must decisively break through $95,000 to confirm the next phase of the rally. Until then, traders should remain cautious as volatility could return at any moment.

Bitcoin Gains Strength But Caution Remains As Global Risks Persist

Bitcoin has gained over 28% in value since April 9th, reigniting optimism across the crypto market. After weeks of bearish pressure and volatility, BTC’s recent move above the critical $90,000 mark signals a major shift in sentiment. Bulls are now in short-term control, and momentum continues to build as Bitcoin attempts to reclaim higher ground and challenge all-time highs.

However, despite the bullish price action, risks remain high. Global trade dynamics continue to create instability, while broader macroeconomic uncertainty still weighs heavily on investor confidence. Since US President Donald Trump’s election victory in November 2024, volatility has dominated global financial markets, and crypto assets have not been immune to these shocks.

Fear continues to linger even as Bitcoin surges. Many investors remain cautious, watching key levels closely to gauge whether this rally can truly be sustained. Analysts stress that any deterioration in trade negotiations could trigger sharp corrections.

Adding a positive note, top analyst Maartunn shared insights on X, revealing that the Coinbase Premium Gap (30-hour moving average) has stayed positive for 265 straight hours—about 11 consecutive days. This marks the fifth-longest buy-spree since ETF trading began, signaling that strong US-based demand continues to fuel the rally.

If Bitcoin maintains this momentum and reclaims $95,000 soon, the path toward $100,000 could open. Until then, cautious optimism remains the dominant tone among investors.

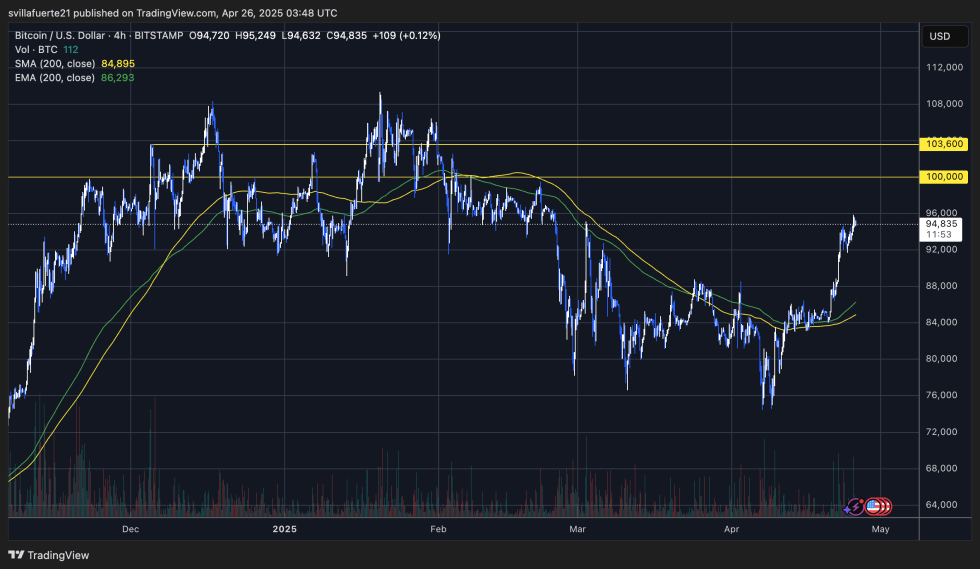

BTC Price Action: Bulls Eye $100K But Must Defend Key Levels

Bitcoin is trading at $94,800 after spending several hours flirting with the $95,000 level, a critical short-term resistance zone. Bulls have shown impressive strength since early April, but now the real test begins: holding gains and pushing toward new highs.

To confirm a sustained rally, BTC must hold firmly above the $90,000 mark and make a decisive move toward reclaiming $100,000 in the coming days. The $90K level has become a psychological and technical anchor for bulls, and defending it will be crucial to maintaining momentum. A clean break above $95K could open the door for a fast push into uncharted territory.

However, if Bitcoin fails to maintain support at $90K, a longer consolidation phase is likely. Such a phase could see BTC trading between the $85K–$90K range for several weeks as the market digests recent gains and evaluates broader macroeconomic conditions.

Investors should remain cautious, as volatility is expected to stay high amid ongoing global tensions and uncertainty. The coming days will be pivotal in determining whether this rally can extend into a full breakout or stalls into sideways consolidation.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/elWNgEm

Comments

Post a Comment