Bitcoin (BTC) is struggling below the $90,000 level, hovering slightly above $85,000, a key support zone that bulls must hold to avoid further downside. Despite positive news regarding the US Strategic Bitcoin Reserve, confirmed by US President Donald Trump’s Executive Order on Thursday, the market has remained under heavy selling pressure, leading to increased volatility and a short-term bearish outlook.

Bears have taken control of price action, pushing BTC into a consolidation phase as traders remain uncertain about its next move. While the announcement of a government-backed Bitcoin reserve was expected to fuel bullish sentiment, the market has yet to reflect any strong buying momentum.

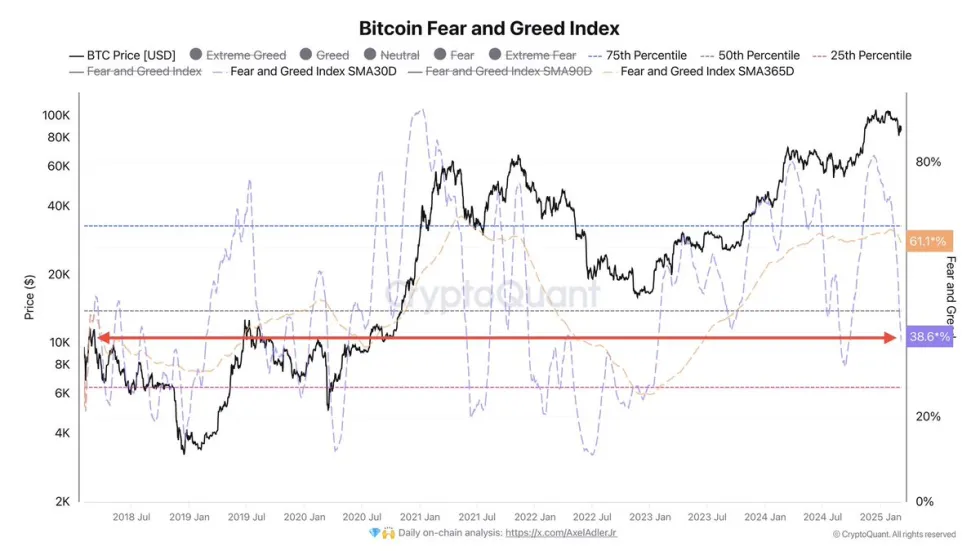

However, on-chain data from CryptoQuant reveals that the average monthly Fear and Greed Index has dropped to an acceptable level, indicating that the worst of the selling pressure may be fading. If BTC holds above $85K and reclaims $90K, a shift in market sentiment could follow. However, if bears continue to dominate, another leg down could push BTC into lower demand zones.

With Bitcoin at a critical level, the coming days will be crucial in determining whether bulls can regain control or if selling pressure will intensify further.

Bitcoin Faces Selling Pressure Amid Global Uncertainty

Bitcoin’s price action continues to deceive investors, particularly those who anticipated 2025 to be an extremely bullish year for both Bitcoin and the broader crypto market. Despite high expectations, BTC has been trending downward since late January, with selling pressure dominating price movements. Even positive developments, such as Trump’s announcement of the US Strategic Bitcoin Reserve, have failed to trigger a sustained rally, leaving investors frustrated.

Market uncertainty remains high, largely driven by fears surrounding global trade wars. Ongoing tensions between major economies, particularly involving US tariff policies, have weighed on both traditional financial markets and crypto, making investors hesitant to take on more risk. This uncertainty has dampened bullish sentiment, keeping Bitcoin below the $90K mark despite attempts at recovery.

Top analyst Axel Adler shared insights on X, suggesting that the recent price swings may not be as significant as they seem. He noted that the average monthly Fear and Greed Index has dropped to an acceptable level, implying that the market’s reaction to recent volatility is stabilizing. He added, “This is local noise. I believe the next trading week should show us what all the US government’s initiatives mean for the market.”

If Adler’s assessment holds true, the coming weeks could bring clarity to Bitcoin’s mid-term trend. Investors are closely watching whether BTC can reclaim $90K, signaling renewed buying interest, or if continued selling pressure will send prices lower. For now, the crypto market remains in a state of uncertainty, with traders waiting for confirmation of the next major move.

Bulls Must Reclaim $90K Soon

Bitcoin is currently trading around $86,000, struggling to establish a clear direction for the coming week. Despite multiple attempts to break higher, BTC remains in a tight range, with neither bulls nor bears showing decisive control over price action.

For bulls to regain momentum, Bitcoin must reclaim the $90,000 level. A strong push above this resistance and a sustained hold would confirm a recovery rally, potentially setting the stage for BTC to target higher price levels. Breaking out of this consolidation phase would likely boost market sentiment and attract renewed buying interest.

However, if BTC fails to reclaim $90K, the market could turn bearish once again. Continued weakness at this level would likely send BTC into lower demand zones, with $85,000 acting as the last key support before a potential move toward $80,000 or lower.

With uncertainty dominating the market, traders are closely monitoring Bitcoin’s price action. The next few days will be crucial in determining whether BTC can break above resistance or if bears will take control and push prices lower.

Featured image from Dall-E, chart from TradingView

from Bitcoinist.com https://ift.tt/s1t3LFZ

Comments

Post a Comment