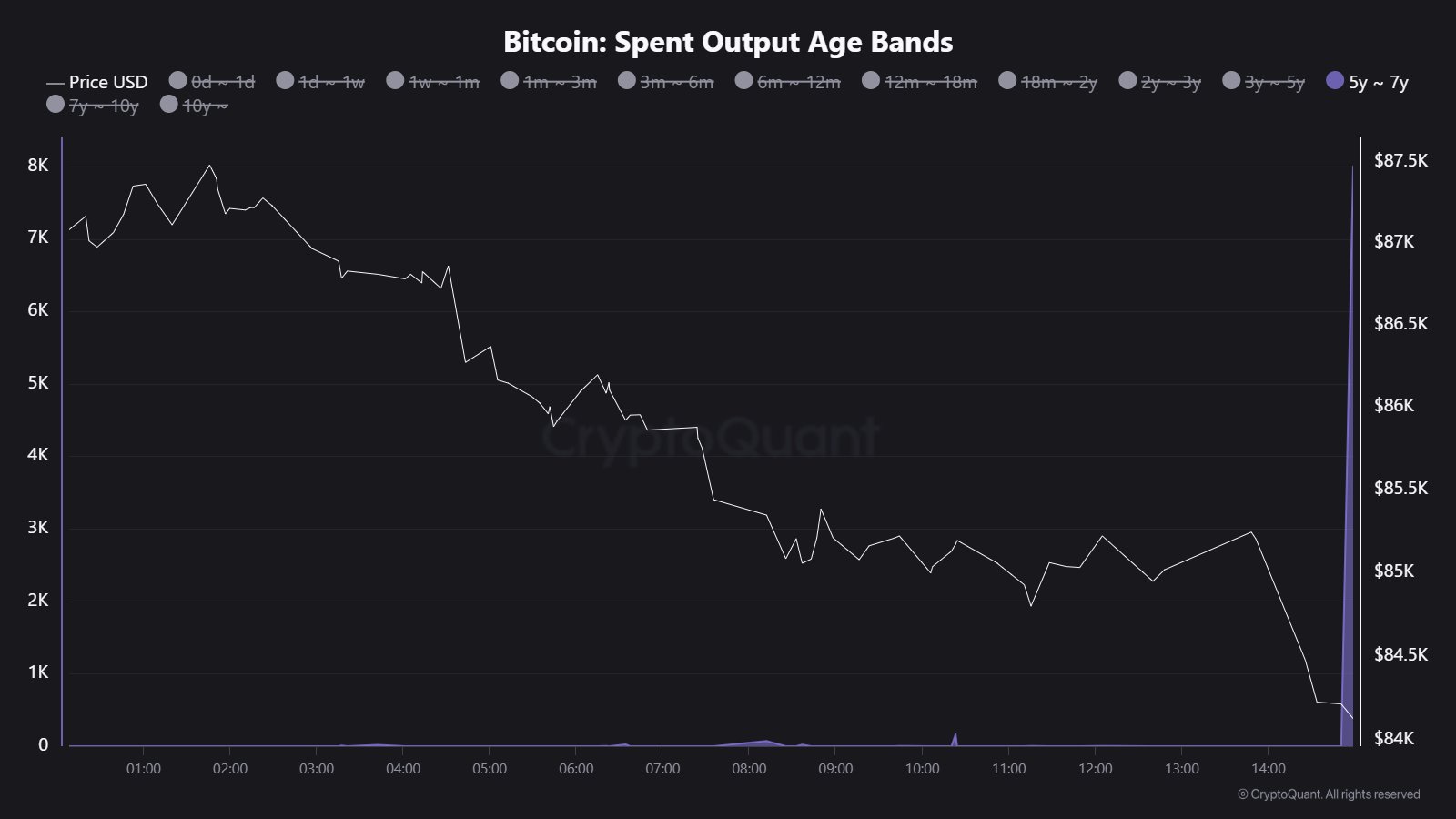

Popular CryptoQuant analyst Maartunn reports that 8,000 Bitcoin (BTC) which have been dormant for five to seven years have been moved suddenly, adding to current bearish concerns in the crypto. This development comes after a rather adventurous week as BTC prices struggled to break above $89,000, following an initial steady bullish climb, before succumbing to heavy selling pressures driven by US President Donald Trump’s hawkish tariff policy.

$674 Million In Old BTC Transfers In Single Block – Cause For Alarm?

The Spent Output Age Bands is a crucial metric to measure how long Bitcoin tokens remain inactive before moving. According to Maartuun in an X post, this metric has recently revealed that 8,000 BTC worth $674 million that was last transferred between 2018 and 2020 have been moved recently in a single block drawing significant market attention.

This transfer follows a string of recent activations of dormant Bitcoin stashes. On March 24, a 14-year inactive Bitcoin wallet suddenly moved 100 Bitcoin valued at $8.5 million. Meanwhile, in early March, six ancient Bitcoin wallets also transferred nearly 250 BTC worth $22 million.

Notably, the most recent transaction reported by Maartuun is of far larger size with potentially strong implications for an uncertain Bitcoin market. Generally, a movement of such a large amount of BTC from long-term dormancy is usually interpreted as a signal for incoming selling pressure leading to major price corrections.

However, there are other potential non-bearish motives behind such transactions such as internal wallet shuffling by institutional investors or large holders as well as a cold storage reorganization. Currently, the owners of the new wallets receiving the 8000 is unknown thus reducing the potential of a bearish reaction from BTC holders.

Bitcoin Price Overview

In the last day, Bitcoin prices declined by 4.00% after the US Government announced intentions to impose a 25% tariff on auto imports and goods from China, Mexico, and Canada starting from April 3. This marks the latest negative reaction of the crypto market to President Trump’s international trade policies following similar incidents in early February and mid-March.

These measures by the Donald Trump administration are flaming fears of a potential economic slowdown which could further push high-risk assets such as BTC out of investors’ portfolios leading to a further downside.

At press time, Bitcoin currently trades at $83,693 reflecting a decline of 0.72% and 2.53% in the last seven and 30 days respectively. Meanwhile, the asset’s daily trading volume is up by 19.38% and is valued at $31.58 billion. The BTC market cap now stands at $1.66 trillion and still represents a dominant 61.1% of the total crypto market.

BTC trading at $83,727 on the daily chart | Source: BTCUSDT chart on Tradingview.com

from Bitcoinist.com https://ift.tt/LPD1a3O

Comments

Post a Comment